- Register in minutes

- Set up your account

- Start trading

- Exness Account Sign Up India Process

- Required Documents for Indian Traders

- Step-by-Step Guide to Opening an Exness Account

- Verification Process for Indian Residents

- Types of Exness Accounts

- After Exness Registration: Next Steps

- Exness Sign Up Bonus

- Benefits of Register Exness Account for Newbies

- Contact Us: Exness Customer Support

- FAQs: Exness Registration

Exness Account Sign Up India Process

The process to register an Exness account is straightforward and designed to help Indian traders start trading quickly. To begin, visit the official Exness website (www.exness.com) and click the “Open Account” or “Register” button, usually found at the top right corner. You’ll need to enter basic details, including your full name, a valid email address, and an active Indian mobile number in the +91 format. Set a secure password using a combination of letters, numbers, and symbols. After completing the registration form to register an Exness account, you’ll receive a verification email and an SMS with a code to confirm your email and phone number. Finalizing these steps ensures a secure process to register an Exness account, granting access to your Personal Area (PA) for account management.

Required Documents for Indian Traders

To comply with Know Your Customer (KYC) regulations, Indian traders must submit specific documents during the Exness sign up process for account verification. The acceptable documents include:

- Aadhaar Card: Ensure the photo is clear, legible, and shows all four edges. Both sides of the card must be visible, and the document should be valid (not expired).

- PAN Card: Provide a high-quality scan or photo showing your full name and PAN number clearly.

- Indian Passport: A valid passport with a clear photo, full name, and date of birth is acceptable. Ensure it has at least one month of validity remaining.

- Proof of Address: Submit a recent utility bill (electricity, water, or gas), bank statement, or rental agreement issued within the last six months. The document must clearly display your full name and current residential address.

For a smooth verification process, ensure all documents are high-resolution, unedited, and match the details provided during the Exness sign up.

Step-by-Step Guide to Opening an Exness Account

Get from here to there without any hassle with our easy-to-follow guidance:

- Go to the Exness website: Access the Exness website and identify the “Sign Up” button and get started.

- Complete the Registration Form: Fill out the required information accurately to ensure a smooth Exness registration process.

- Choose Account Type: Choose your preferred account type based on your trading preferences.

- Customise trading settings: Customise your trading settings to match your particular needs.

- Verification steps: Follow the verification steps to confirm your identity and ensure account security.

- Congratulations! You have successfully opened your Exness trading account and are ready to jump into the exciting world of trading.

Verification Process for Indian Residents

After completing the Exness sign up, Indian traders must verify their account to unlock full functionality, such as higher deposit limits and withdrawals. Log in to your Exness Personal Area, navigate to the “Verify Account” section, and upload the required documents (listed above). You’ll also need to complete an economic profile, answering questions about your source of income, profession, and trading experience. Verification typically takes up to 24 hours, though high-quality documents can speed up the process. If documents are rejected, Exness will provide a reason, such as unclear images or expired documents. Resubmit corrected documents promptly to avoid delays. Once verified, you’ll receive a confirmation notification, granting access to all trading features.

Types of Exness Accounts

Exness offers a variety of account types to suit different trading styles and experience levels for Indian traders completing the Exness sign up:

- Standard Account: Ideal for beginners, with no commissions, spreads starting from 0.3 pips, and a low minimum deposit of $10 (approximately ₹800–1,000).

- Standard Cent Account: Perfect for new traders, allowing micro-trading with cent lots and a $10 minimum deposit. Best for low-risk practice.

- Pro Account: Designed for experienced traders, offering tighter spreads (from 0.1 pips) and instant or market execution.

- Raw Spread Account: Suited for scalpers and day traders, with raw spreads and a small commission per trade.

- Zero Account: Provides zero spreads on major currency pairs with a fixed commission, ideal for high-frequency traders.

Each account type supports MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms, allowing Indian traders to choose based on their strategy and goals.

Open Exness Demo Account

Experience risk-free trading by following these simple steps to open an Exness demo account:

- Go to the Exness website: Start the process by accessing the official Exness website.

- Find “Open Demo Account”: Look for the clear option for “Open Demo Account” on the homepage.

- Fill out the details: Complete the registration form with the required information, including your name, email, and preferred account settings.

- Accept Terms: Review and approve the terms and conditions presented by Exness.

- Confirmation Email: Check your email for a confirmation message and follow the link provided to verify the account.

- Access Demo Account: Once verified, log in to your Exness demo account and explore the platform’s features in a risk-free environment.

Start Trading with Exness Live Account

Get started on your live trading journey from an Exness Live Account, with the ease of transferring from a Demo Account:

- Log in or Sign up: If you already have a demo account, log in to Exness. If not, sign up for a new account by following the steps above.

- Transfer to a live account: In your demo account interface, find the option to transfer to a live account.

- Provide additional information: Complete additional information required for a live account, such as financial details and personal identification.

- Fund Account: Fund your Exness Live account using one of the available payment methods.

- Verify your identity: Complete the identity verification process, in accordance with security regulations.

- Start Live Trading: Once your account is funded and verified, you are ready to start trading live on Exness.

Exness offers a variety of live accounts, such as Standard and Professional accounts, designed to meet the diverse needs of individual traders. These accounts vary in features such as leverage, spreads, Exness payment methods, and Exness minimum deposit requirements. You can see the main features of these accounts and the differences between them in a table below:

| Account Type | Minimum Deposit | Spread | Commission | Maximum Leverage | Instruments Available |

|---|---|---|---|---|---|

| Standard | Depends on payment system | From 0.2 pips | No commission | 1 | Forex, Metals, Cryptocurrencies, Energy, Stocks |

| Standard Cents | Depends on payment system | From 0.3 pips | No commission | 1 | Forex, Metals |

| Raw Spread | $200 | From 0 pips | Up to $3.50 per lot per direction | 1 | Forex, Metals, Cryptocurrencies, Energy, Stocks |

| Zero | $200 | From 0 pips | From $0.2 per lot per direction | 1 | Forex, Metals, Cryptocurrencies, Energy, Stocks |

| Pro | $200 | From 0.1 pips | No commission | 1 | Forex, Metals, Cryptocurrencies, Energy, Stocks |

To start trading with a live account, complete the registration and verification process, and then deposit funds into your account, with several deposit methods available.

After Exness Registration: Next Steps

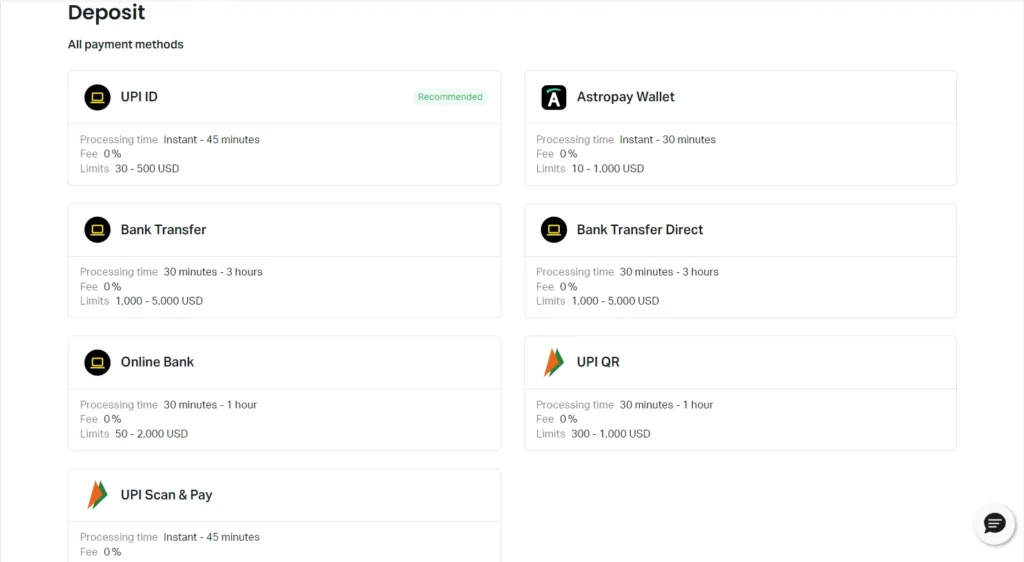

Once your Exness sign up and verification are complete, the next step is to fund your account to start trading. Follow these instructions for your first deposit:

- Log in to Your Personal Area: Access your Exness account using your registered email and password.

- Navigate to the Deposit Section: Find the “Deposit” option in your dashboard.

- Choose a Payment Method: Exness supports Indian-friendly options like UPI (Google Pay, PhonePe, Paytm), net banking, debit/credit cards, and e-wallets (Skrill, Neteller). Select INR to avoid currency conversion fees.

- Enter Deposit Amount: Ensure the amount meets the minimum requirement for your account type (e.g., $10 for Standard or Standard Cent accounts).

- Confirm the Transaction: Follow the prompts to complete the deposit. Most methods, like UPI, process instantly with no Exness fees, though bank charges may apply.

Exness offers a variety of options to support different user preferences and locations, ensuring ease and accessibility for you to deposit funds into your account:

- Bank transfers

Safe and traditional for large deposits.

- E-wallets

Such as PayPal, Skrill, and Neteller, which offer fast and simple deposits.

- Credit/Debit cards

Convenient for fast and hassle-free transactions.

- Cryptocurrencies

For those who prefer modern digital currency transactions.

Each method has its own benefits, and the selection depends on your convenience, transaction speed preference, and accessibility. This flexibility is important in managing your financial resources effectively and being supported with your business strategy.

Exness Sign Up Bonus

At Exness, we are proud of our special position in the financial trading industry, which ties together our clear commitment to the fundamental values of transparency and fair trading practices. In accordance with these principles, we have decided that we will not offer sign up bonuses to our Privy users. This choice reflects our unwavering dedication to ethical business and strict regulatory compliance.

Instead of a sign up bonus, we are pleased to introduce you to our comprehensive partnership programs, which have been carefully designed to create a supportive relationship between Exness and our valued partners. These programs offer a breadth of collaborative opportunities, providing a foundation for shared success and growth.

Benefits of Register Exness Account for Newbies

Registering with Exness offers a number of benefits that are especially beneficial to those who are new to the trading field. Here are some of these benefits:

- User-Partner Interface: Exness offers an intuitive and easy to communicate trading platform, suitable for new beginners.

- Learning Materials: Access educational materials, tutorials, and webinars to learn about trading.

- Demo Account: Gain experience by practising trading with a demo account without expecting to withdraw any real money.

- MT4 and MT5 Support: The Exness MT4 and Exness MT5 platforms feature advanced charting, automated trading, and customization for different trading styles.

- WebTerminal: Trade directly from your web browser with the Exness WebTerminal, offering convenience and accessibility.

- Exness Mobile App: Ideal for trading on the go, the Exness app provides real-time data, simple trade execution, and efficient account management.

- Low Minimum Deposit: Trading with a starting deposit that is convenient to reach for new beginners.

- Customer Support: Important for newbies to trade, whenever you need it.

- Risk Management Tools: Use advanced tools to manage and minimise potential losses.

Contact Us: Exness Customer Support

Exness builds on customer support in that it provides extremely excellent support. If you need assistance, you can contact Exness Customer Support through various means:

Exness Help Centre:

Access comprehensive support and guidance for all trading related queries.

Live Chat:

Available on the Exness website for immediate support.

Email Support:

Send your queries to the support email address provided on the website.

Phone Support:

Call the support number for direct assistance.

FAQ Section:

Visit the FAQ section on the website for answers to common questions.

Customer support at Exness is designed with your convenience in mind, always available to assist regardless of your time zone or trading schedule. Our dedicated support team is on hand if you need guidance, have questions about the registration process, need clarification on platform features or help with any aspects of your trading experience. This ongoing support ensures you can navigate the complexities of trading with confidence, knowing that expert support is just a message or call away, around the clock.

FAQs: Exness Registration

What documents are required for Exness registration?

For Exness registration, you need a valid photo ID such as a passport or driving licence, and proof of residence such as a utility bill or bank statement. These are important for identity verification and meeting regulatory standards.