- 8 लाख से अधिक व्यापारी

- 10 डॉलर न्यूनतम जमा

- असीमित लाभोत्तोलन

- तुरंत निकासी कुछ ही सेकंडों में

- Exness आदर्श विकल्प क्यों है?

- Exness विनियमन

- भारतीय व्यापारियों की समीक्षाएँ

- Exness ट्रेडिंग प्लेटफार्म

- Exness ट्रेडिंग उपकरण

- Exness खातों के प्रकार

- Exness मानक खाते

- Exness व्यावसायिक खाते

- Exness डेमो खाता

- Exness सोशल ट्रेडिंग

- खातों की तुलना

- Exness खाता पंजीकरण

- Exness की सुरक्षा

- Exness फंड की जमा और निकासी

- भारतीय भुगतान विधियों के लिए समर्थन

- Exness शैक्षिक संसाधन

- Exness ग्राहक सहायता

- Exness द्वारा दिए जाने वाले बोनस और पुरस्कार

- भारतीय विनियमों का अनुपालन

- पूछे जाने वाले प्रश्न

ट्रेडर्स के लिए एक विश्वसनीय फॉरेक्स ब्रोकर का महत्व

व्यापारियों के लिए एक विश्वसनीय फॉरेक्स ब्रोकर बहुत महत्वपूर्ण है। यह सुचारू व्यापार, सटीक डेटा और अच्छे प्लेटफॉर्म सुनिश्चित करता है। यह सुरक्षा भी प्रदान करता है, समर्थन देता है, और व्यापारियों की सुरक्षा के लिए नियमों का पालन करता है। यह सफल विदेशी मुद्रा व्यापार के लिए आत्मविश्वास का निर्माण करता है।

क्यों Exness आदर्श विकल्प है

Exness भारतीय व्यापारियों के लिए आदर्श है। यह पारदर्शिता के लिए विनियमित है और मानकों का पालन करता है। Exness कई ट्रेडिंग उपकरण प्रदान करता है। इसके प्लेटफॉर्म MT4 और MT5 में कुशल ट्रेडिंग के लिए उन्नत उपकरण हैं।

Exness व्यापारी ज्ञान में सुधार के लिए शिक्षा संसाधन प्रदान करता है। इसमें विभिन्न ट्रेडिंग शैलियों के लिए खाता प्रकार हैं। Exness की स्पष्ट शर्तें, प्रतिस्पर्धी मूल्य निर्धारण, और विभिन्न भुगतान विकल्प हैं। यह Exness को भारत में ऑनलाइन ट्रेडिंग के लिए एक विश्वसनीय साझेदार बनाता है।

Exness के बारे में

Exness एक ऑनलाइन ब्रोकर है जिसकी शुरुआत 2008 में हुई थी। यह साइप्रस में स्थित है लेकिन भारत सहित वैश्विक स्तर पर व्यापारियों की सेवा करता है। यहाँ Exness के बारे में कुछ मुख्य तथ्य हैं:

- वैश्विक उपस्थिति: इसके कई देशों में कार्यालय हैं, जिससे यह विश्वभर में व्यापारियों को स्थानीय समर्थन और सेवाएं प्रदान करने में सक्षम है।

- नियमित संस्था: 5 से अधिक वित्तीय प्राधिकरणों द्वारा नियमित, जो अनुपालन और सुरक्षा सुनिश्चित करता है।

- ट्रेडिंग वॉल्यूम: अपने प्लेटफार्मों पर मासिक रूप से 5 ट्रिलियन डॉलर से अधिक के ट्रेडिंग वॉल्यूम की सेवा प्रदान करता है।

नियमन और लाइसेंस

Exness कई विभिन्न अधिकार क्षेत्रों में कई प्रतिष्ठित नियामक प्राधिकरणों की देखरेख में काम करता है। यहाँ कुछ लाइसेंस और नियामक संस्थाएं हैं जो Exness के संचालन को नियंत्रित करती हैं:

- साइप्रस सिक्योरिटीज और एक्सचेंज कमीशन (CySEC): Exness (Cy) Ltd. को CySEC द्वारा लाइसेंस संख्या 178/12 के साथ अधिकृत और विनियमित किया गया है।

- यूनाइटेड किंगडम में वित्तीय आचार प्राधिकरण (FCA): Exness (UK) Ltd. को FCA द्वारा लाइसेंस संख्या 730729 के साथ अधिकृत और विनियमित किया गया है।

- सेशेल्स में वित्तीय सेवा प्राधिकरण (FSA): Exness (SC) Ltd. को FSA द्वारा लाइसेंस संख्या SD025 के साथ अधिकृत और विनियमित किया गया है।

- दक्षिण अफ्रीका में वित्तीय क्षेत्र आचरण प्राधिकरण (FSCA): Exness ZA (PTY) Ltd. को FSCA द्वारा FSP संख्या 51024 के साथ अधिकृत किया गया है।

भारतीय व्यापारियों से समीक्षाएँ

संदीप मिश्रा, मुंबई

Exness तेजी से निकासी, कम स्प्रेड्स, और सहायक ग्राहक सेवा प्रदान करता है। मुझे उनके साथ कोई समस्या नहीं हुई है, और मेरे सौदे हमेशा जल्दी से हो जाते हैं।

अनन्या पटेल, नई दिल्ली

मुझे यह पसंद है कि Exness कितना विश्वसनीय है। उनका मोबाइल ऐप और डेस्कटॉप प्लेटफॉर्म दोनों ही बिना किसी समस्या के काम करते हैं, जिससे ट्रेडिंग करना आसान हो जाता है। उनके गाइड्स ने मेरी ट्रेडिंग स्किल्स को काफी बेहतर बनाया है, और शुरू से ही समग्र अनुभव सकारात्मक रहा है।

राहुल सिंह, बेंगलुरु

Exness की स्वचालित निकासी एक खेल परिवर्तक है। मुझे मेरा पैसा सेकंडों में मिल जाता है। प्लेटफॉर्म का उपयोग करना आसान है और व्यापारों को पहचानने के लिए अच्छे उपकरण हैं।

प्रिया देसाई, चेन्नई

डेमो खाते ने मुझे असली पैसे का उपयोग करने से पहले ट्रेडिंग का अभ्यास करने में मदद की। उनकी सहायता टीम जल्दी से सवालों का जवाब देती है और हमेशा मित्रवत होती है। खाता विकल्प और सरल पंजीकरण प्रक्रिया ने मेरे लाइव ट्रेडिंग में संक्रमण को सहज बना दिया।

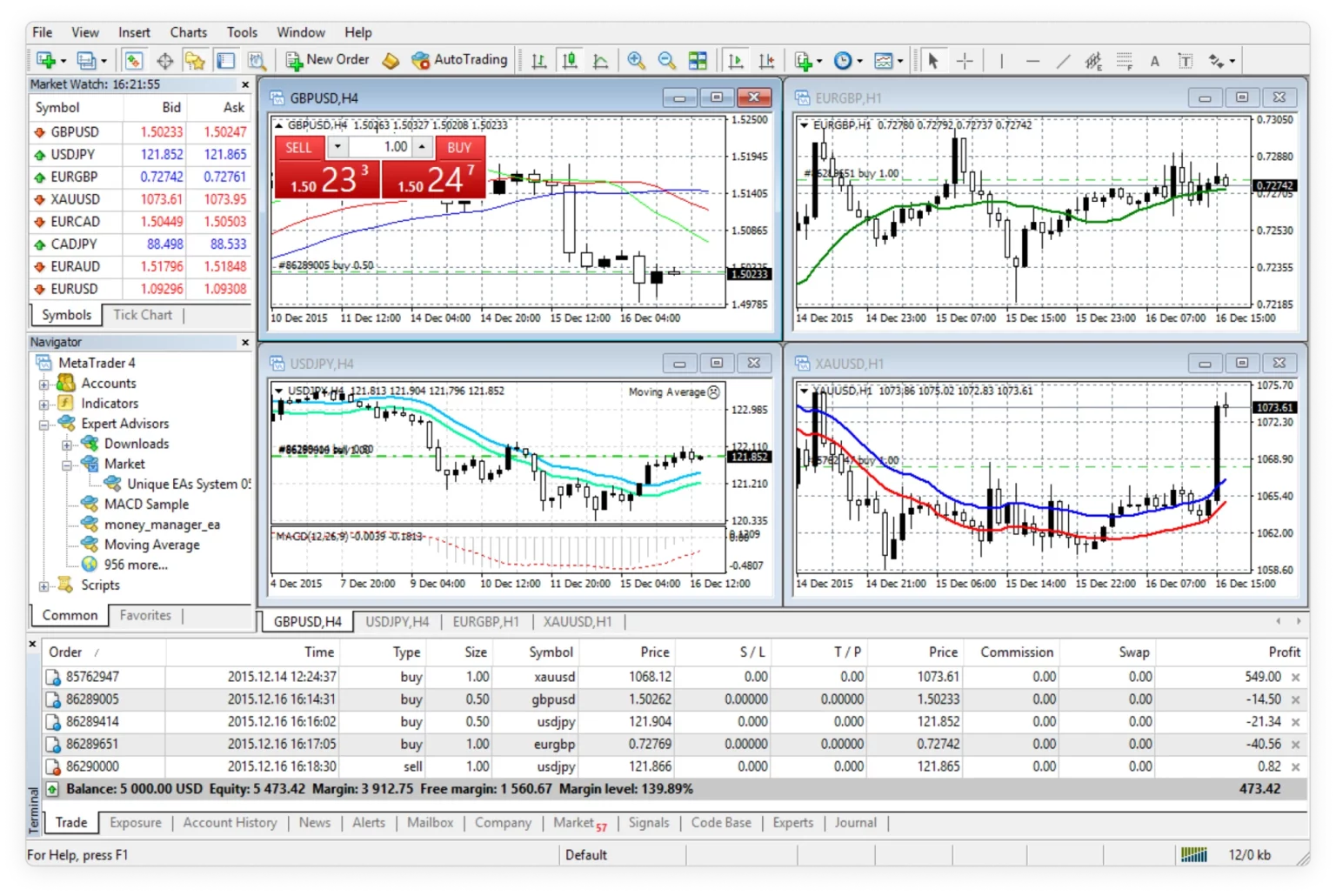

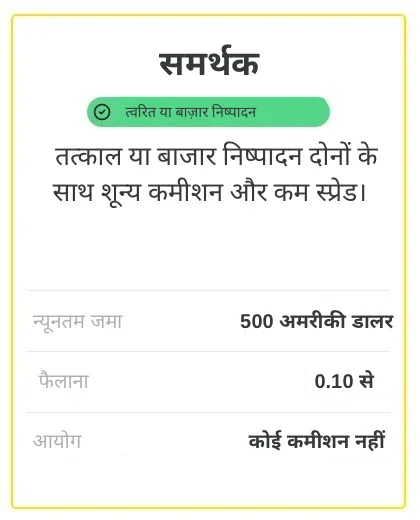

Exness ट्रेडिंग प्लेटफॉर्म

“ब्रोकर विभिन्न प्रकार के ट्रेडिंग प्लेटफॉर्म प्रदान करता है। ट्रेडर्स MetaTrader 4, MetaTrader 5, Exness Terminal, और MetaTrader Web Terminal के बीच चुन सकते हैं। मोबाइल ऐप्स भी उपलब्ध हैं, जैसे कि Exness ऐप और MetaTrader 4/5 मोबाइल ऐप। प्रत्येक प्लेटफ़ॉर्म अपने अनोखे टूल्स और सुविधाओं का एक सेट प्रदान करता है। इसमें कोई संदेह नहीं है कि ट्रेडर्स के लिए सबसे लोकप्रिय विकल्प MT4 और MT5 प्लेटफॉर्म हैं।”

Exness MetaTrader 4 (MT4)

MetaTrader 4 आपको फॉरेक्स, इंडिसीज़, और क्रिप्टोकरेंसी सहित 200 से अधिक इंस्ट्रूमेंट्स तक पहुँच प्रदान करता है। आप छह प्रकार के पेंडिंग ऑर्डर्स का उपयोग कर सकते हैं, ट्रेडिंग सिग्नल्स को कस्टमाइज़ कर सकते हैं, और अपनी रणनीति को 30 तकनीकी संकेतकों के साथ सुधार सकते हैं। Exness MT4 प्लेटफॉर्म तेजी से निष्पादन का मतलब है कि आपके ट्रेड्स कुछ सेकंड में संसाधित हो जाते हैं। MT4 शुरुआती और अनुभवी ट्रेडर्स दोनों के लिए उपयुक्त है।

Exness MetaTrader 5 (MT4)

मेटाट्रेडर 5, एमटी4 की सफलता पर आधारित है, जिसमें अधिक उन्नत सुविधाएं और एक आधुनिक इंटरफेस है। Exness MT5 प्लेटफॉर्म विंडोज के लिए 38 तकनीकी संकेतक, 21 समय सीमाएँ, और आर्थिक कैलेंडर और बाजार की गहराई जैसे बेहतर उपकरण शामिल हैं। यह नेटिंग और हेजिंग ट्रेडिंग सिस्टम्स का समर्थन करता है, जो आपके व्यापारों को प्रबंधित करने में और भी अधिक लचीलापन और सटीकता प्रदान करता है।

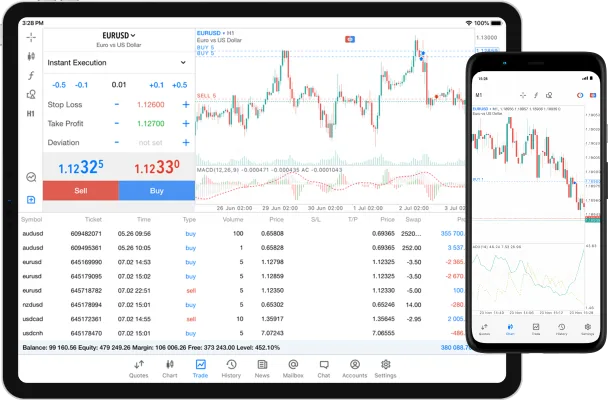

Exness मोबाइल ऐप्स

दलाल उपयोगकर्ता-अनुकूल मोबाइल ऐप्स प्रदान करता है जो व्यापारियों को डेस्कटॉप संस्करण के समान कार्यक्षमता के साथ व्यापार करने की अनुमति देते हैं। Exness Trader ऐप एक स्वामित्व मोबाइल प्लेटफॉर्म है जो एक-स्पर्श जमा और निकासी, वास्तविक समय के चार्ट, और बाजार समाचार जैसी सुविधाएं प्रदान करता है। यह एंड्रॉइड और iOS पर उपयोगकर्ताओं के लिए उपलब्ध है। आप इस ऐप का उपयोग करके 100 से अधिक वित्तीय साधनों तक पहुँच सकते हैं।

जो लोग MetaTrader प्लेटफॉर्म को पसंद करते हैं, Exness उनके लिए MetaTrader 4 और MetaTrader 5 मोबाइल ऐप्स भी प्रदान करता है।

Exness MetaTrader 4 मोबाइल

MT4 मोबाइल ऐप फोन और टैबलेट दोनों पर काम करता है। इसमें चार्ट विश्लेषण और तेजी से क्रियान्वयन जैसे आपको चाहिए सभी व्यापारिक सुविधाएं हैं।

Exness MetaTrader 5 मोबाइल

MT5 का मोबाइल ऐप में MT4 की तुलना में अधिक चार्ट प्रकार और उपकरण हैं। आप ट्रेड्स का विश्लेषण कर सकते हैं, समाचार अलर्ट प्राप्त कर सकते हैं, और अपनी स्थितियों का प्रबंधन – सभी अपने फोन से कर सकते हैं।

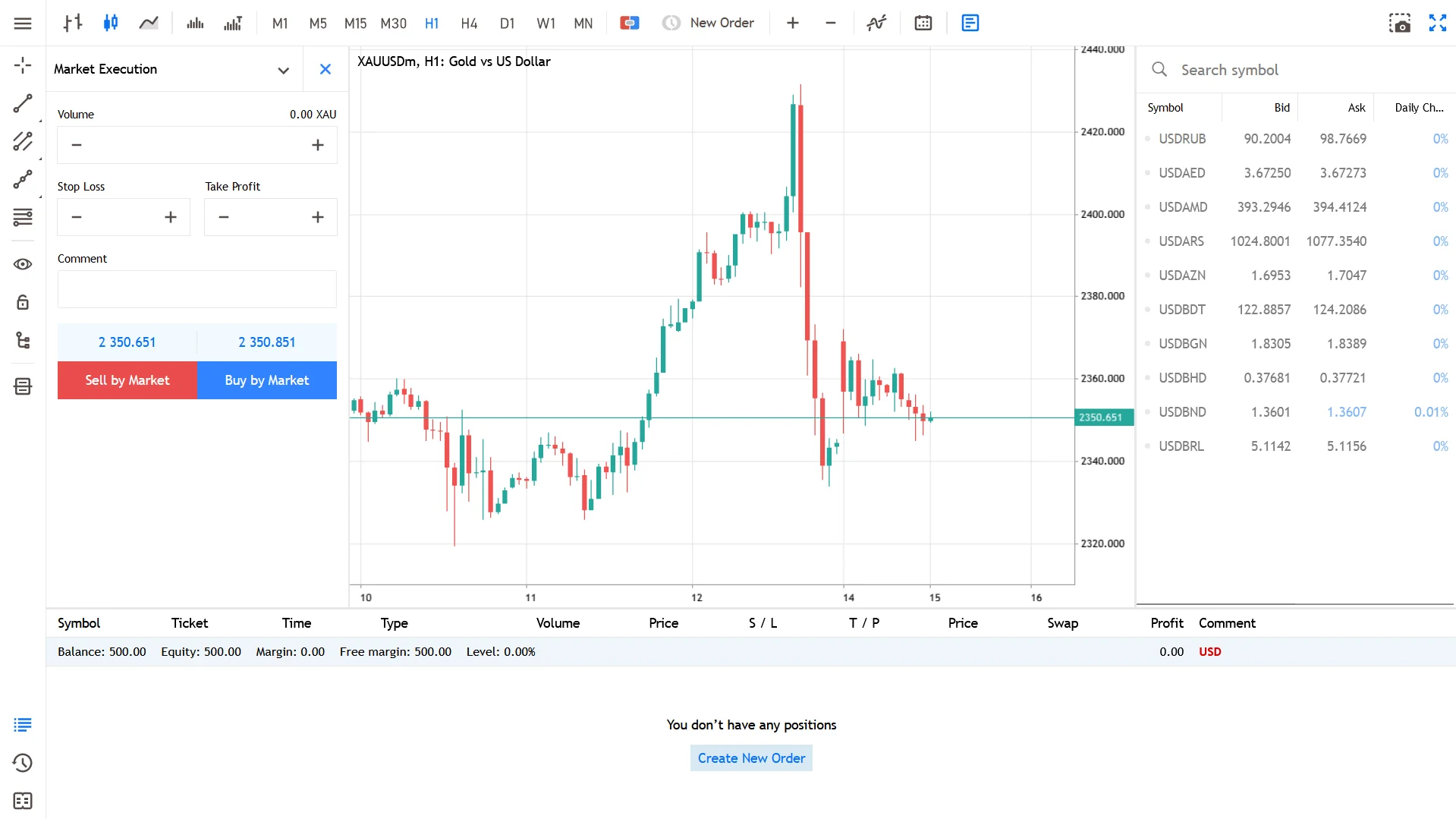

Exness वेब टर्मिनल

Exness WebTerminal एक वेब-आधारित ट्रेडिंग प्लेटफॉर्म है जो सीधे आपके ब्राउज़र से काम करता है। आप किसी भी सॉफ्टवेयर को इंस्टॉल किए बिना चार्ट्स का विश्लेषण कर सकते हैं और तेजी से ट्रेड कर सकते हैं। इसमें ट्रेडिंग के अवसरों को पहचानने में मदद के लिए 9 समय सीमाएँ, 30 संकेतक और 3 चार्ट प्रकार शामिल हैं। बस साइन अप करें, 5 खाता प्रकारों में से चुनें, और आप वेबटर्मिनल का उपयोग करने के लिए तैयार हैं।

Exness मेटाट्रेडर वेबटर्मिनल

यह मेटाट्रेडर 4 या 5 का संस्करण आपको किसी भी उपकरण से ब्राउज़र के माध्यम से व्यापार करने की अनुमति देता है। आप वास्तविक समय के बाजार डेटा तक पहुँच सकते हैं, चार्ट्स का विश्लेषण कर सकते हैं, और तेजी से ट्रेड्स को अंजाम दे सकते हैं।

Exness में उपलब्ध ट्रेडिंग इंस्ट्रूमेंट्स

Exness 200+ ट्रेडिंग इंस्ट्रूमेंट्स का विशाल चयन प्रदान करता है, जो व्यापारियों को पैसे कमाने के अपार अवसर प्रदान करता है।

विदेशी मुद्रा

100 से अधिक मुद्रा जोड़े जिनमें मुख्य जैसे कि EUR/USD और GBP/USD के साथ-साथ लघु और विदेशी मुद्राएं भी शामिल हैं। 1:2000 तक के लीवरेज के साथ, आप अपनी जोखिम पसंद के अनुसार अपनी ट्रेडिंग रणनीति को अनुकूलित कर सकते हैं। प्रतिस्पर्धी स्प्रेड 0.1 पिप्स से शुरू होते हैं।

स्टॉक्स पर CFDs

प्रौद्योगिकी, उपभोक्ता सामान, और अन्य क्षेत्रों में 70 से अधिक स्टॉक CFDs तक पहुंच प्राप्त करें। आप Apple (AAPL) और Tesla (TSLA) जैसे शेयरों का व्यापार कम कमीशन पर और 1:20 तक के लिवरेज के साथ कर सकते हैं।

सूचकांकों पर CFDs

NASDAQ 100 और FTSE 100 सहित 10+ सूचकांकों पर CFDs का व्यापार करें। कम फैलाव का लाभ उठाएं और 1:100 तक का लाभ उठाएं।

वस्तुओं पर CFDs

Exness, सोना, चांदी, कच्चा तेल, और प्राकृतिक गैस जैसी लोकप्रिय वस्तुओं पर CFDs प्रदान करता है। 0.1 पिप्स से शुरू होने वाले स्प्रेड्स और 1:200 तक के लीवरेज के साथ, आप नए अवसरों को पा सकते हैं।

क्रिप्टोकरेंसीज

पारंपरिक बाजारों के अलावा, Exness व्यापारियों को 8 लोकप्रिय क्रिप्टोकरेंसीज, जैसे कि बिटकॉइन, एथेरियम, लाइटकॉइन, और रिपल की मूल्य गतिविधियों पर अनुमान लगाने की सुविधा प्रदान करता है।

Exness खातों के प्रकार

Exness दो प्रकार के खाते प्रदान करता है, जिन्हें स्टैंडर्ड्स (स्टैंडर्ड, स्टैंडर्ड सेंट) और प्रोफेशनल्स (रॉ स्प्रेड, जीरो, प्रो) में विभाजित किया गया है। Exness खाता प्रकार उनकी विशेषताओं जैसे कि स्प्रेड्स, शुल्क और उपलब्ध उपकरणों में भिन्न होते हैं।

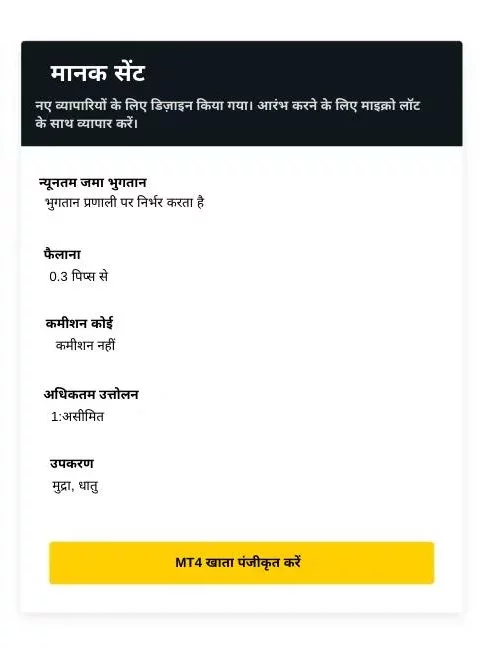

Exness मानक खाते

| खाता प्रकार | न्यूनतम जमा | लाभ उठाना | स्प्रेड (से) | कमीशन |

| मानक | कोई न्यूनतम नहीं | 1 से लेकर: असीमित | 0.3 पिप्स | कोई नहीं |

| मानक सेंट | कोई न्यूनतम नहीं | 1 से लेकर: असीमित | 0.3 पिप्स | कोई नहीं |

मानक

स्टैंडर्ड खाता अधिकांश व्यापारियों के लिए बहुत अच्छा है, जो कमीशन नहीं लेता है और कम स्प्रेड प्रदान करता है। यह फॉरेक्स, धातुओं, और सूचकांकों जैसे विभिन्न व्यापारिक साधनों तक पूरी पहुँच प्रदान करता है।

मानक सेंट

स्टैंडर्ड सेंट खाता शुरुआती लोगों के लिए उत्तम है। यह आपको छोटे “सेंट लॉट्स” में व्यापार करने देता है, जबकि जोखिम को प्रबंधित करना और रणनीतियों का परीक्षण करना सीखते हैं।

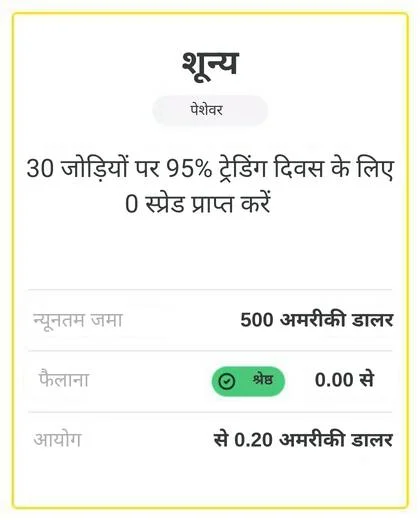

Exness प्रोफेशनल खाते

| खाता प्रकार | न्यूनतम जमा | लाभ उठाना | स्प्रेड (से) | प्रति लॉट कमीशन |

| कच्चा फैलाव | $200 | 1:2000 तक | 0.0 पिप्स | 3.5 डॉलर तक |

| शून्य | $200 | 1:2000 तक | 0.0 पिप्स | 20 सेंट से |

| प्रो | $200 | 1:2000 तक | 0.1 पिप्स | कोई नहीं |

कच्चा फैलाव

रॉ स्प्रेड अकाउंट उन व्यापारियों के लिए डिज़ाइन किया गया है जो कम स्प्रेड्स की तलाश में हैं। स्प्रेड्स 0.0 पिप्स तक कम हो सकते हैं, लेकिन प्रति लॉट थोड़ा कमीशन लिया जाता है।

शून्य

ट्रेडिंग दिन के 95% समय के लिए स्प्रेड्स 0.0 पिप्स से शुरू होने के कारण, जीरो खाता सटीक ट्रेडिंग रणनीतियों के लिए एक शीर्ष पसंद है। प्रति लॉट कमीशन लिया जाता है।समर्थक

समर्थक

प्रो खाता 0.1 पिप्स से शुरू होने वाले कसे हुए स्प्रेड्स और कोई कमीशन नहीं, जो पेशेवर-स्तरीय स्थितियों की चाहत रखने वाले व्यापारियों के लिए आदर्श है, प्रदान करता है।

Exness डेमो खाता

डेमो खाता ट्रेडिंग का अभ्यास करने का एक जोखिम-मुक्त तरीका है। Exness अपने सभी ट्रेडिंग प्लेटफॉर्म्स के लिए डेमो खाते प्रदान करता है, जिनमें MetaTrader 4, MetaTrader 5, और Exness Trader शामिल हैं। प्रत्येक डेमो खाता आपको 100 से अधिक वित्तीय साधनों तक पहुँच प्रदान करता है, जिसमें फॉरेक्स जोड़े, स्टॉक्स, सूचकांकों, और कमोडिटीज पर CFDs शामिल हैं। आप असली बाजार की स्थितियों में अपनी रणनीतियों का परीक्षण करने के लिए $10,000 तक के वर्चुअल बैलेंस से शुरुआत कर सकते हैं, जिसमें 1:2000 तक का लिवरेज मिलता है। इससे आप अपने कौशल को निखार सकते हैं और लाइव खाते में स्विच करने से पहले विभिन्न ट्रेडिंग उपकरणों से परिचित हो सकते हैं।

Exness सोशल ट्रेडिंग

Exness एक सोशल ट्रेडिंग प्लेटफॉर्म प्रदान करता है, जो व्यापारियों को सफल व्यापारियों की रणनीतियों का अनुसरण करने और उन्हें कॉपी करने में सक्षम बनाता है। इससे शुरुआती लोगों के लिए शीर्ष व्यापारियों का अनुसरण करके सीखने और कमाने में आसानी होती है।

खातों की तुलना

आपकी ट्रेडिंग जरूरतों के लिए सही खाता चुनने में मदद के लिए, यहाँ Exness खाता प्रकारों का सारांश है:

| खाता प्रकार | न्यूनतम जमा | लाभ उठाना | स्प्रेड (से) | कमीशन | बाजार निष्पादन | अधिकतम आदेश | न्यूनतम पद का आकार | ट्रेडिंग प्लेटफॉर्म(स) |

| मानक | कोई न्यूनतम नहीं | 1 से लेकर: असीमित | 0.3 पिप्स | कोई नहीं | हाँ | 1,000 | 0.01 लॉट्स | MT4, MT5 |

| मानक सेंट | कोई न्यूनतम नहीं | 1 से लेकर: असीमित | 0.3 पिप्स | कोई नहीं | हाँ | 1,000 | 0.01 सेंट के लॉट | MT4 |

| कच्चा फैलाव | $200 | 1:2000 तक | 0.0 पिप्स | प्रति लॉट $3.5 तक | हाँ | 1,000 | 0.01 लॉट्स | MT4, MT5 |

| शून्य | $200 | 1:2000 तक | 0.0 पिप्स | $0.2/प्रति लॉट | हाँ | 1,000 | 0.01 लॉट्स | MT4, MT5 |

| प्रो | $200 | 1:2000 तक | 0.1 पिप्स | कोई नहीं | हाँ | 1,000 | 0.01 लॉट्स | MT4, MT5 |

मानक खाते बनाम पेशेवर खाते:

- मानक खाते अधिकांश व्यापारियों के लिए आदर्श होते हैं, जिनमें कोई कमीशन नहीं होता है और स्प्रेड्स व्यापक होते हैं।

- पेशेवर खातों में अधिक संकीर्ण स्प्रेड होते हैं लेकिन इन पर कमीशन लागू होता है या इनके लिए न्यूनतम जमा राशि की आवश्यकता होती है।

डेमो बनाम लाइव खाते:

- डेमो खाते ट्रेडिंग रणनीतियों का अभ्यास करने के लिए वर्चुअल फंड्स का उपयोग करते हैं।

- लाइव खाते असली पैसे का उपयोग करते हैं और आपको बाजार व्यापार साधनों तक पूरी पहुँच प्रदान करते हैं।

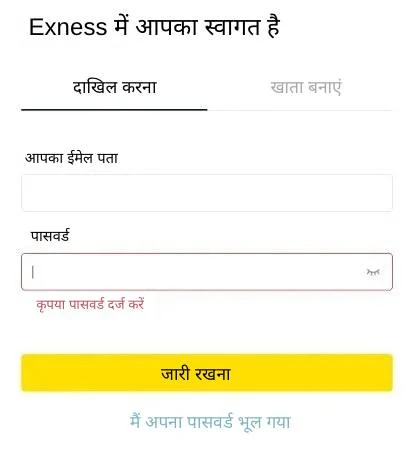

Exness खाता पंजीकरण प्रक्रिया

Exness के साथ पंजीकरण में कुछ चरण होते हैं और यह केवल कुछ मिनटों में हो जाता है। बस इन कदमों का पालन करें, और आप तैयार हैं:

- साइन अप करें: Exness वेबसाइट पर जाएँ या Exness ऐप का उपयोग करें। “ओपन अकाउंट” पर क्लिक करें और अपना ईमेल, निवास का देश, और पासवर्ड प्रदान करें।

- सूचना की पुष्टि करें: अपने व्यक्तिगत विवरण भरें और KYC प्रक्रिया को पूरा करने के लिए आवश्यक दस्तावेज (जैसे पासपोर्ट या ड्राइविंग लाइसेंस) जमा करके अपनी पहचान की पुष्टि करें।

- खाता प्रकार चुनें: अपनी आवश्यकताओं के अनुसार ट्रेडिंग खाते का प्रकार चुनें, जैसे कि स्टैंडर्ड, प्रो, या रॉ स्प्रेड।

- धनराशि जमा करें: ट्रेडिंग शुरू करने के लिए उपलब्ध स्थानीय या अंतरराष्ट्रीय भुगतान विधियों में से किसी का उपयोग करके धनराशि जोड़ें।

- ट्रेडिंग शुरू करें: अपने पसंदीदा ट्रेडिंग प्लेटफॉर्म (MT4, MT5, या Exness Terminal) तक पहुंचें और अपने नए बनाए गए खाते के साथ ट्रेडिंग शुरू करें।

Exness Broker की सुरक्षा और सुरक्षा

Exness अपने ग्राहकों की सुरक्षा और सुरक्षितता की गारंटी देता है। यहाँ कैसे:

- पृथक खाते: ग्राहकों के धन को Exness के परिचालन धन से अलग रखा जाता है, जिससे आपके पैसे की अतिरिक्त सुरक्षा प्रदान की जाती है।

- मुआवजा कोष: वित्तीय आयोग के सदस्य के रूप में, Exness विवाद की स्थिति में प्रति ग्राहक €20,000 तक की पेशकश करता है।

- SSL एन्क्रिप्शन: ट्रेडिंग प्लेटफॉर्म्स और Exness सर्वरों के बीच आदान-प्रदान किया गया सभी डेटा SSL प्रौद्योगिकी का उपयोग करके एन्क्रिप्ट किया जाता है, ताकि आपकी संवेदनशील जानकारी की सुरक्षा की जा सके।

दो-कारक प्रमाणीकरण (2FA) आपके खाते में एक अतिरिक्त सुरक्षा की परत जोड़ता है। यह अनधिकृत लॉगिन को रोकने में मदद करता है और सुनिश्चित करता है कि केवल आपको ही पहुंच हो।

Exness नियमित रूप से सुरक्षा जाँच भी करता है और आपके डेटा को सुरक्षित रखने के लिए 24/7 सब कुछ मॉनिटर करने वाली एक साइबर सुरक्षा टीम है।

Exness ट्रेडिंग की शर्तें

“Exness व्यापारियों के लिए कुछ सबसे अनुकूल व्यापारिक स्थितियाँ प्रदान करता है। विशिष्ट खातों पर स्प्रेड्स 0.0 पिप्स से शुरू होते हैं, जबकि स्टैंडर्ड खातों के लिए लीवरेज 1:असीमित तक और प्रोफेशनल खातों के लिए 1:2000 तक जा सकता है। बाजार निष्पादन तेज व्यापार पूर्ति सुनिश्चित करता है, और कोई छिपी हुई फीस नहीं है। इसके अलावा, Exness आपके खाते को शून्य से नीचे जाने से रोकने के लिए नकारात्मक शेष राशि सुरक्षा प्रदान करता है। व्यापारिक रणनीतियों की योजना बनाने के लिए, संभावित लाभों का अनुमान लगाने में मदद करने के लिए Exness लाभ कैलकुलेटर उपलब्ध है।”

Exness फंड्स की जमा और निकासी

Exness के साथ जमा और निकासी सरल हैं। आप केवल $1 से शुरू होकर धनराशि जमा कर सकते हैं, और आपके निकासी तुरंत प्रक्रिया की जाती हैं। अधिकांश भुगतान विधियों के लिए कोई अतिरिक्त शुल्क नहीं होने के कारण, आप स्थानीय भुगतान विकल्पों, ई-वॉलेट्स, बैंक हस्तांतरण, और क्रेडिट/डेबिट कार्डों का उपयोग करके आसानी से अपने खाते को फंड कर सकते हैं।

भारत में स्थानीय भुगतान पद्धतियों का समर्थन

- UPI (यूनिफाइड पेमेंट्स इंटरफेस): अपने बैंक खाते से सीधे तत्काल लेन-देन करें।

- Paytm: इस लोकप्रिय मोबाइल वॉलेट का उपयोग त्वरित जमा और निकासी के लिए करें।

- भारतीय नेट बैंकिंग: आपके खाते में से और आपके खाते में सीधे धन हस्तांतरण के साथ सुरक्षित ऑनलाइन बैंकिंग।

- स्थानीय बैंक स्थानांतरण: अपने Exness खाते और अपने स्थानीय बैंक के बीच सीधे धन स्थानांतरित करें।

“ये भुगतान विकल्प भारतीय व्यापारियों को उनकी स्थानीय मुद्रा में अपने धन का प्रबंधन करने में मदद करते हैं। जो लोग ट्रेडिंग शुरू करने में रुचि रखते हैं, उनके लिए भारत में Exness न्यूनतम जमा लगभग सभी के लिए किफायती स्तर पर है।”

Exness शैक्षिक संसाधन

Exness व्यापारियों की सहायता के लिए मूल्यवान उपकरण प्रदान करता है:

- वेबिनार: बाजार के विशेषज्ञों द्वारा संचालित लाइव सत्र, अक्सर प्रति सप्ताह 2-3 सत्र होते हैं।

- लेख: 10+ ट्रेडिंग रणनीतियों और मुख्य बाजार प्रवृत्तियों को कवर करने वाले लिखित मार्गदर्शिकाएँ।

- वीडियो ट्यूटोरियल: शुरुआती और अनुभवी व्यापारियों के लिए 30 से अधिक चरण-दर-चरण वीडियो।

- Exness Academy: एक ऑनलाइन केंद्र जहाँ व्यापारी बाजार विश्लेषण और शैक्षिक सामग्री पा सकते हैं।

Exness ग्राहक सहायता

Exness, लाइव चैट, ईमेल, और फोन के माध्यम से 24/7 सहायता प्रदान करता है। सहायता 15+ भाषाओं में उपलब्ध है, जिसमें अंग्रेजी, हिंदी, और चीनी शामिल हैं। इससे सामान्य समस्याओं या जटिल व्यापार संबंधी प्रश्नों पर सहायता प्राप्त करना आसान हो जाता है।

Exness सहायता केंद्र में ट्रेडिंग प्लेटफॉर्म, खाता सेटअप, और सुरक्षा पर FAQs और मार्गदर्शिकाएँ भी भरी हुई हैं, ताकि व्यापारी जल्दी से उत्तर पा सकें।

Exness द्वारा प्रदान किए गए बोनस और पुरस्कार

जबकि Exness वर्तमान में बोनस प्रदान नहीं करता है, Exness Premier कार्यक्रम उच्च-मात्रा वाले व्यापारियों को तेजी से निकासी, व्यक्तिगत खाता प्रबंधकों, और बाजार की अंतर्दृष्टि जैसे विशेष लाभ प्रदान करता है। यह वफादारी कार्यक्रम व्यापारियों को उनकी गतिविधि के लिए पुरस्कृत करता है।

Exness Broker के भारतीय नियमों का पालन

Exness भारतीय व्यापार नियमों का पालन करने के लिए सख्त अंतरराष्ट्रीय दिशा-निर्देशों का पालन करता है। दलाल वित्तीय सेवा प्राधिकरण (FSA) मानकों का पालन करता है और वैश्विक मानकों को पूरा करने के लिए अपने संचालन का नियमित रूप से ऑडिट करता है।

दलाल ग्राहक को जानो (KYC) जांच का उपयोग पहचान सत्यापित करने के लिए करता है और धोखाधड़ी गतिविधि को रोकने के लिए धन-शोधन निवारण (AML) प्रक्रियाओं का पालन करता है। ये कदम हर लेन-देन में पारदर्शिता सुनिश्चित करते हैं।

नियमित ऑडिट और स्पष्ट आंतरिक नियम Exness को अनुपालन में रखते हैं और व्यापारियों को भारतीय नियामक दिशा-निर्देशों के भीतर सुरक्षित, न्यायसंगत वातावरण प्रदान करते हैं।

पूछे जाने वाले प्रश्न

क्या भारत में Exness के साथ ट्रेडिंग सुरक्षित और विश्वसनीय है?

हां, Exness सुरक्षित और विश्वसनीय है। यह अंतरराष्ट्रीय नियमों का पालन करता है और ग्राहकों के धन को अलग-अलग खातों में रखता है। यह 128-बिट एन्क्रिप्शन का उपयोग करके व्यक्तिगत डेटा की सुरक्षा करता है, जिससे भारतीय व्यापारी आत्मविश्वास के साथ व्यापार कर सकें।