- Choose your Exness account type.

- Select your desired trading instrument.

- Determine the lot size and proceed to calculate.

What is the Exness Calculator?

The Exness Calculator is a multifunctional tool designed to provide traders with precise calculations regarding their trading activities. It encompasses a comprehensive suite of features, including but not limited to:

- Profit/Loss Estimation: It calculates the potential profit and loss of trades based on current market conditions, assisting traders in evaluating the effectiveness of their strategies.

- Margin Requirement: The calculator computes the necessary margin to keep open positions, crucial for leverage and capital management.

- Additional Calculations: Apart from profit and margin, it also provides calculations on pip values, swap fees, and commission costs, catering to the trading needs of individuals across all trading parameters.

Benefits of the Exness Profit Calculator

The Exness Profit Calculator brings several significant advantages in the business scenario, creating a valuable asset for traders to optimize their strategies and manage risks in a better organized manner. These benefits include:

- Instant Calculation: It provides real-time calculations on potential outcomes, assisting traders in making quick, informed decisions.

- Risk Management Assistance: By providing information on potential losses and required margins, the calculator helps traders better manage their strategies.

- Strategic Plan Support: With the ability to project future profits and assess various trading scenarios, traders can prepare their investment plans strategically.

- User-Friendly Interface: Designed with the user in mind, the calculator simplifies complex trading calculations, making it accessible for both novices and experienced traders.

- Comprehensive Analysis: It goes beyond basic calculations and includes various business factors in its analysis, offering a holistic perspective on potential trading outcomes.

Step-by-Step Guide to Using the Exness Calculator

When using the Exness Calculator, traders input specific trade details to unlock a comprehensive analysis, crucial for evaluating potential outcomes before planning and execution. This analysis ensures that traders have the necessary insights to positively navigate the complexities of financial markets.

Here is a comprehensive guide to help you maximize its possibilities:

- Get started by registering or logging into your Exness account. Go to the Tools section of your dashboard where you’ll find a ready-to-use Exness calculator.

- Based on your business needs, select the specific calculator you wish to use. The Exness platform offers various calculators, including Profit/Loss, Margin, Pip Value, and Swap Fees.

- Enter your trade details, such as account type, currency, trading instrument, lot size, and leverage. This accuracy helps tailor the calculation to your business situation.

- Review calculations for necessary margin, spread costs, potential commission, swap fees, and pip value. This information helps you understand what financial outcomes to expect from your proposed trade.

- Adjust your trading parameters using the information from the calculator. Experiment with different lot sizes, leverages, and instruments to see how these changes can impact your potential outcomes.

- Once you are satisfied with the calculated scenario and have understood the potential risks and rewards, you can implement this strategy in your live trading activities.

- Regularly utilize the Exness Calculator before trading to forecast outcomes and manage risks effectively. Over time, it will assist you in refining your trading strategies for better success rates.’

Description of Standard Parameters

When using the Exness Calculator, traders need to specify several key parameters so that its output can be tailored to their specific trading conditions, enhancing the importance and accuracy of its calculations.

This entry defines the business situations to which it will apply, including leverage options and the available spread sizes for the trader. Different account types offer different conditions that can significantly impact traders’ profit and risk levels.

It is essential for this parameter that the results of the calculations are presented in the currency that traders can easily understand and relate to their account balance. This change is crucial for a clear understanding of the financial impact of trades.

The selection of trading instruments is crucial because each has specific characteristics that affect calculation parameters such as pip value and margin requirements. Choosing the right instrument ensures that the calculator’s output accurately reflects potential trading outcomes in the specific market.

Represents the quantity of the trade and is directly related to potential profit or loss. Lot size is a primary determinant of trade size and impacts the amount of capital at risk.

By adjusting leverage, traders can control the size of their position relative to their investment capital. Leverage is a powerful tool that can magnify both potential gains and losses, making it a crucial factor in risk management and capital allocation strategies.

Explanation of Results

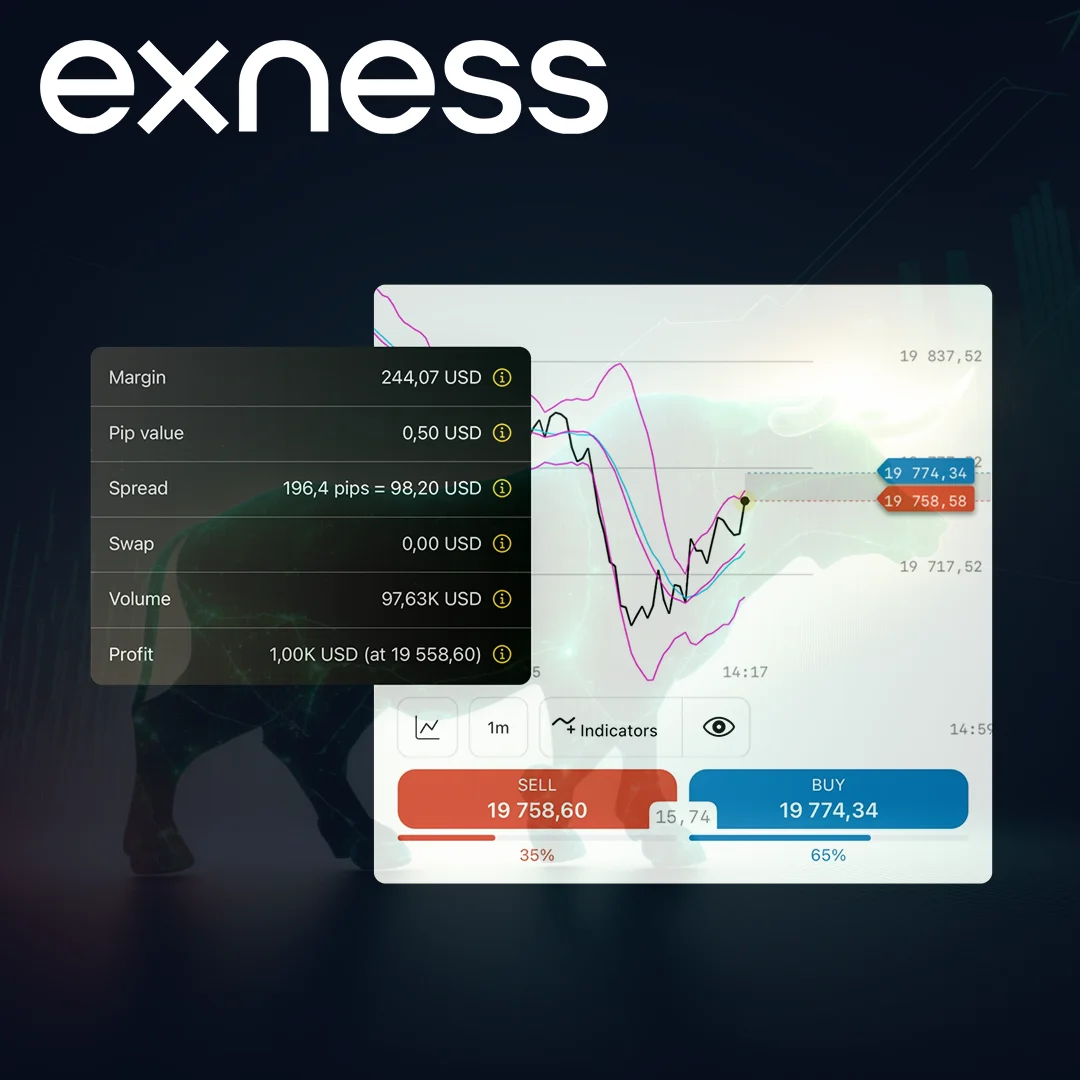

The output of the calculator provides estimates in various financial aspects of planned trades, including direct costs and potential earnings.

Margin:

This shows the amount of capital required to open and maintain a position, serving as a vital budgeting tool for traders. Understanding margin requirements is essential for effective capital management.

Spread Cost:

The difference between the buying and selling price at the time of trade entry is displayed here. This cost directly impacts the initial expenditure in entering a trade and can affect the overall profitability.

Commission:

Details of any broker fees for executing a trade are provided here. Commission is an important consideration when calculating the net profit or loss of a trade.

Swap Short:

Swap short shows the payment or receipt of interest for overnight short positions, determining the difference in interest rates between traded currencies. It is positive if the rate of the sold currency is higher, impacting the trade’s profitability.

Swap Long:

Swap long applies to overnight long positions, where the impact of interest rates in included currency rates is considered. If the rate of the bought currency is higher than the sold currency, a positive value is generated, affecting trade outcomes.

Pip Value:

This displays the value of one pip movement in the account currency. Understanding pip value is crucial for assessing the potential impact of market movements on trades.

These results provide traders with a comprehensive view of the financial implications of their planned trades. By analyzing these parameters, traders can make informed decisions about their trading strategies and risk management.

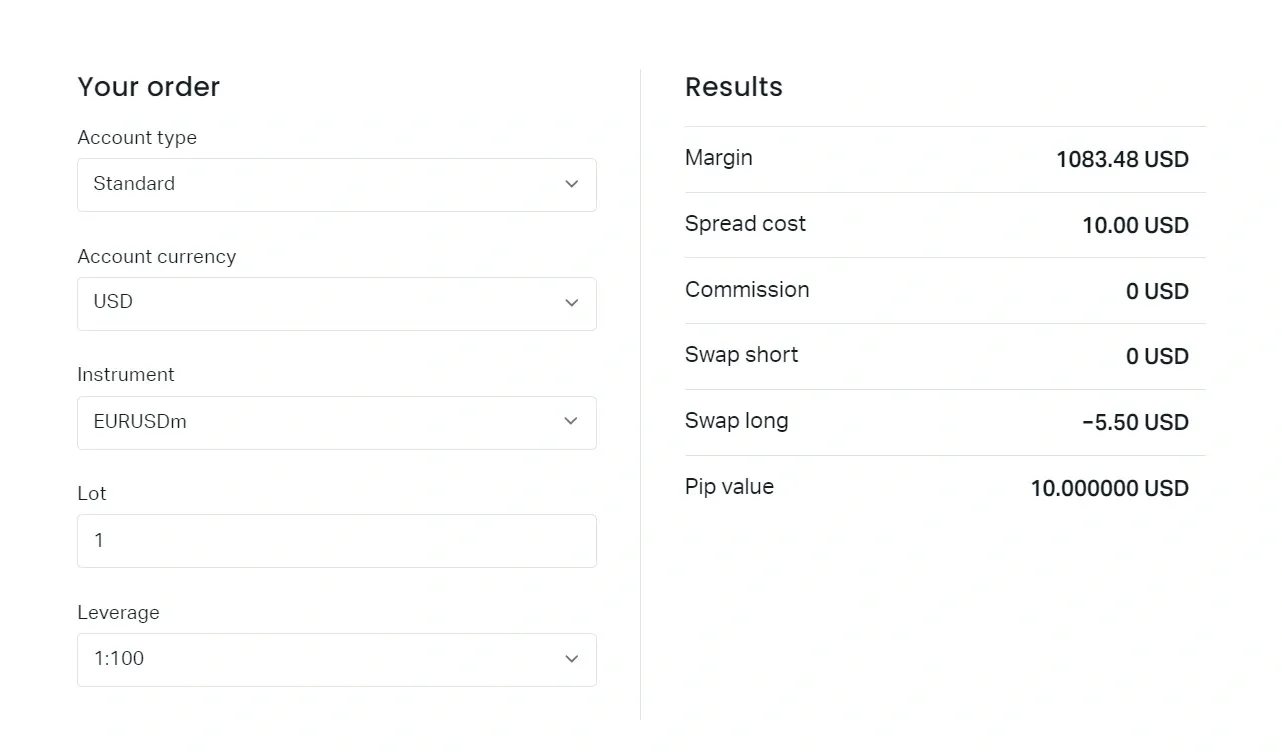

Example of Using the Exness Trading Calculator

Imagine a trader planning to open a long position on the EUR/USD currency pair with the following parameters:

- Account Type: Standard

- Account Currency: USD

- Instrument: EUR/USD

- Lot Size: 1 Lot (100,000 units)

- Leverage: 1:100

After entering these details into the Exness Calculator, the trader needs to check what the calculated results are:

| Result | Explanation |

| Margin: 1083.48 USD | This figure indicates the necessary funds required to open and maintain the position. It is determined based on leverage and the total value of the trade, ensuring the trader has sufficient funds to cover potential losses. |

| Spread Cost: 10.00 USD | The spread cost shows the difference in buying and selling prices at the time of the trade. A $10 spread cost indicates this amount is already paid as a trading cost, impacting the initial profitability of the trade. |

| Commission: 0 USD | This indicates that no brokerage commission is charged for this specific trade. While some trades may incur commission, in this case, the trade is commission-free, reducing the overall cost of the trade. |

| Swap Short: 0 USD | A swap fee is an interest payment made for holding a position overnight. Since this is a short swap, it indicates no interest is charged for holding a short position overnight. |

| Swap Long: -5.50 USD | For holding a long position overnight, a swap fee of $5.50 is charged. This fee is deducted from the trade’s profitability and is worth considering for trades held overnight or longer. |

| Pip Value: 10.000000 USD | The pip value shows how much the price of the currency pair will change in a single pip movement. Here, each pip movement in the trade is valued at $10, meaning a 1 pip increase or decrease in the EUR/USD pair will result in a $10 profit or loss, respectively. |

Advanced Features of the Exness Calculator

The calculator goes beyond simple estimated profit and loss calculations, embedding functions that ensure the development of risk management strategies, aligning with individual trading preferences and ensuring compatibility with trading platforms such as MT4, MT5, WebTerminal. Together, these features enable traders to navigate the market with increased confidence and accuracy.

Advanced Risk Management

This feature of the Exness calculator empowers traders with the ability to prudently manage their risks. By enabling the adjustment of risk parameters such as stop-loss levels and take-profit points, traders can develop compatible strategies with their risk tolerance, ensuring they can safeguard their capital more effectively.

Customization Options

Recognizing that no two traders are alike, the Exness calculator offers extensive customization options. Traders can modify inputs based on their specific trading conditions, preferences, and strategies. This level of customization ensures that the calculator’s output is not merely generic estimates but specialized features capable of directly influencing business decisions.

Integration with Trading Platforms

One of the excellent features of the Exness calculator is its ability to integrate seamlessly with trading platforms. This means traders can directly apply the insights from their calculations to their trading actions without the need for any manual data transfers. Such integration streamlines the trading process and reduces the margin for error.

Conclusion

The calculator created by the Exness broker goes beyond a simple calculation tool. It is a strategic partner in trade. With detailed analysis, risk management capabilities, customization options, and integration with limited platforms, it empowers traders to process critical data and take action needed to make informed decisions and strategic planning. Whether it’s suitable for novice traders looking to understand the basics, or seasoned market players managing risk or adapting complex strategies, the Exness calculator is a fundamental component of a successful trading prospect.

Exness Calculator: Q&A

How to use the Exness Forex calculator for business activities?

Enter information such as selected instruments, lot size, and leverage in the business calculator. It will then provide estimates of potential profit or loss, aiding in informed trading decisions.