Main Account Types Offered by Exness

The main account types at Exness are:

- Standard Accounts – For regular retail traders. Good for getting started with real money.

- Professional Accounts – For advanced and high-volume traders. Have special features and pricing.

- Islamic (Swap-Free) Account – An account that doesn’t charge overnight swaps/rollovers for holding positions. Useful for Muslim traders.

- Demo Account – A practice account with virtual money. Great for learning to trade before risking real capital.

Exness offers a wide range of Exness accounts. You should choose the one that best suits your experience and needs.

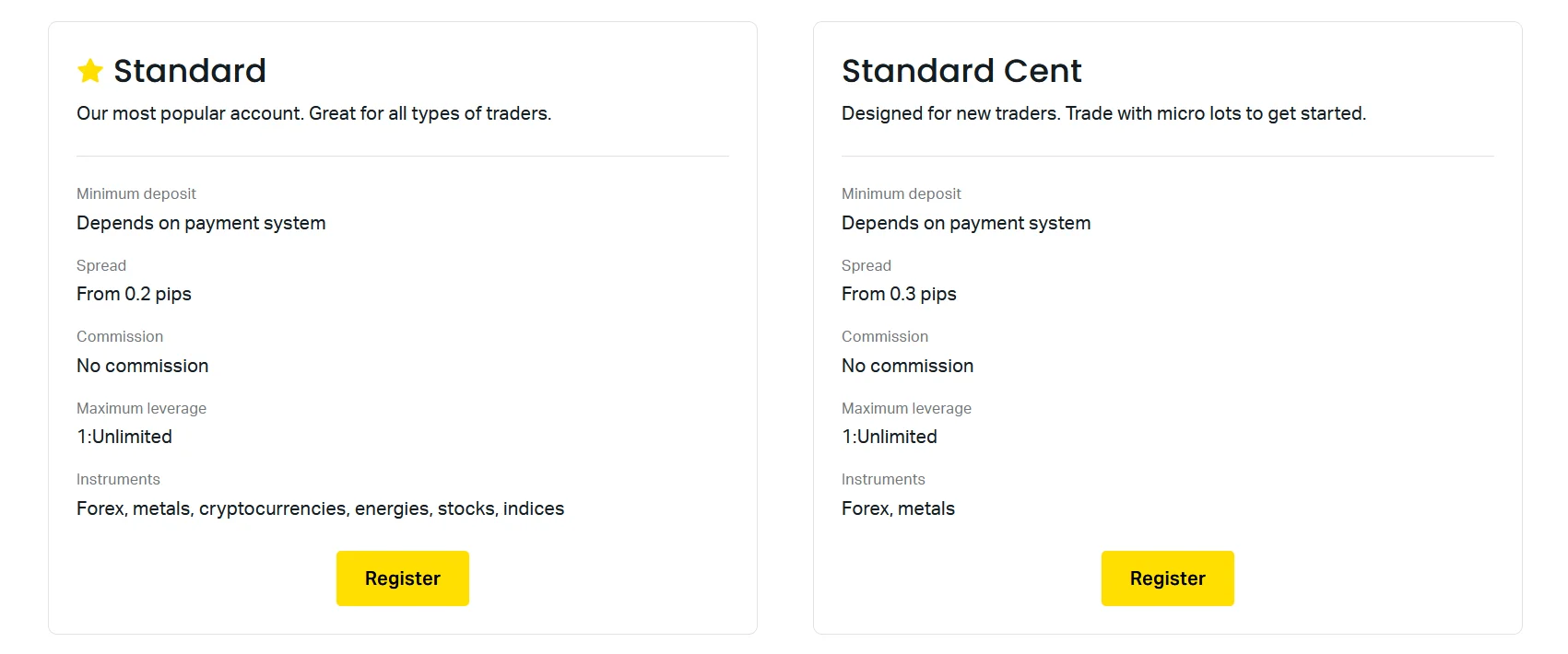

Exness Standard Accounts

Exness provides two types of Standard accounts: the Standard Account and the Standard Cent Account. These accounts are great for beginners.

Standard Account

| Feature | Details |

| Minimum Deposit | No minimum requirement |

| Leverage | Up to 1:Unlimited |

| Spreads | Starting from 0.3 pips |

| Commission | None |

| Instruments | Forex, metals, cryptocurrencies, indices, and stocks |

| Platforms | MetaTrader 4, MetaTrader 5 |

The Standard account is very popular at Exness. Many traders use this account type. It’s easy to open and you only need $1 to get started.

The Standard account offers tight spreads from just 0.3 pips with no dealing commissions. You can trade with high leverage up to 1:2000. It works great for strategies like scalping and day trading.

Exness Standard Cent Account

| Feature | Details |

| Minimum Deposit | No minimum requirement |

| Leverage | Up to 1:Unlimited |

| Spreads | Starting from 0.3 pips |

| Commission | None |

| Instruments | Forex and metals |

| Platforms | MetaTrader 4 |

This is a micro account where prices are quoted in cents instead of pips. The tiny $0.10 minimum deposit size makes it perfect for beginners with small funds. You can trade nano lots from just 1 cent!

This account is available exclusively on Exness MetaTrader 4, making it simple and easy to use.

Both accounts give you user-friendly platforms, no commission, high leverage and low spreads to trade forex and more.

Exness Professional Account

Exness offers three types of Professional accounts: Raw Spread, Zero, and Pro. These accounts provide superior pricing and execution in exchange for higher trading volumes.

Exness Raw Spread Account

| Feature | Details |

| Minimum Deposit | $200 |

| Leverage | Up to 1:2000 |

| Spreads | Starting from 0.0 pips |

| Commission | Up to $3.5 per lot |

| Instruments | Forex, metals, indices, and cryptocurrencies |

| Platforms | MetaTrader 4, MetaTrader 5 |

The Raw Spread account gives you institutional-level spreads from 0 pips – you only pay a $3.5 commission per lot round turn. This makes it very appealing for scalpers and high-frequency traders.

However, there are some trade-offs like lower leverage up to 1:2000 and a higher $200 minimum deposit. But if your trading volumes are high, the superior pricing can really boost your profits.

Exness Zero Account

This account has even tighter spreads compared to the Raw Spread account, with no markup whatsoever.

| Feature | Details |

| Minimum Deposit | $200 |

| Leverage | Up to 1:2000 |

| Spreads | 0.0 pips on 95% of trading day |

| Commission | From $0.2 per lot |

| Instruments | Forex, metals, indices, and cryptocurrencies |

| Platforms | MetaTrader 4, MetaTrader 5 |

As you can see, the spreads are literally from 0 pips with no markups from Exness at all. The compromise is that you pay a $0.2 commission per lot one-way.

The substantial $200 minimum deposit requirement means this account is geared towards professional traders and institutions. But the honest, zero markup spreads are a major advantage.

Exness Pro Account

| Feature | Details |

| Minimum Deposit | $200 |

| Leverage | Up to 1:2000 |

| Spreads | Starting from 0.1 pips |

| Commission | None |

| Instruments | Forex, metals, indices, cryptocurrencies |

| Platforms | MetaTrader 4, MetaTrader 5 |

The Pro Account offers fast market execution with spreads starting from 0.1 pips and no commissions, making it suitable for traders who want high-speed execution at a low cost. The account requires a $200 minimum deposit and offers leverage up to 1:2000, which can be a significant advantage for more experienced traders looking to maximize their potential returns.

Islamic (Swap-Free) Account

The Exness Islamic (Swap-Free) Account is for traders who follow Islamic finance principles. This account doesn’t have overnight swap fees and aligns with Shariah law.

| Feature | Details |

|---|---|

| Minimum Deposit | Varies depending on the account type |

| Leverage | Up to 1:Unlimited |

| Spreads | Varies based on account type |

| Commission | None |

| Instruments | Forex, metals, indices, cryptocurrencies |

| Platforms | MetaTrader 4, MetaTrader 5 |

You can choose the Islamic option on both Exness Standard and Exness Professional accounts. This swap-free feature ensures that you won’t be charged overnight fees. It’s perfect for those following Islamic principles who want to trade forex pairs, metals, indices, and other assets.

Exness Demo Account

The Exness demo account allows you to trade without using real money. With virtual funds, it is a safe way to test strategies and learn how the platforms work.

| Feature | Details |

|---|---|

| Starting Balance | Virtual funds, customizable |

| Leverage | Up to 1:Unlimited |

| Spreads | Starting from 0.3 pips |

| Commission | None |

| Instruments | Forex, metals, indices, cryptocurrencies |

| Platforms | MetaTrader 4, MetaTrader 5 |

The Demo Account is ideal for new traders who want to practice, or experienced traders who need to try out new strategies. You can set your starting balance and use virtual money to trade in a real-like environment. It’s a great way to get familiar with both MetaTrader 4 and MetaTrader 5 without any financial risk.

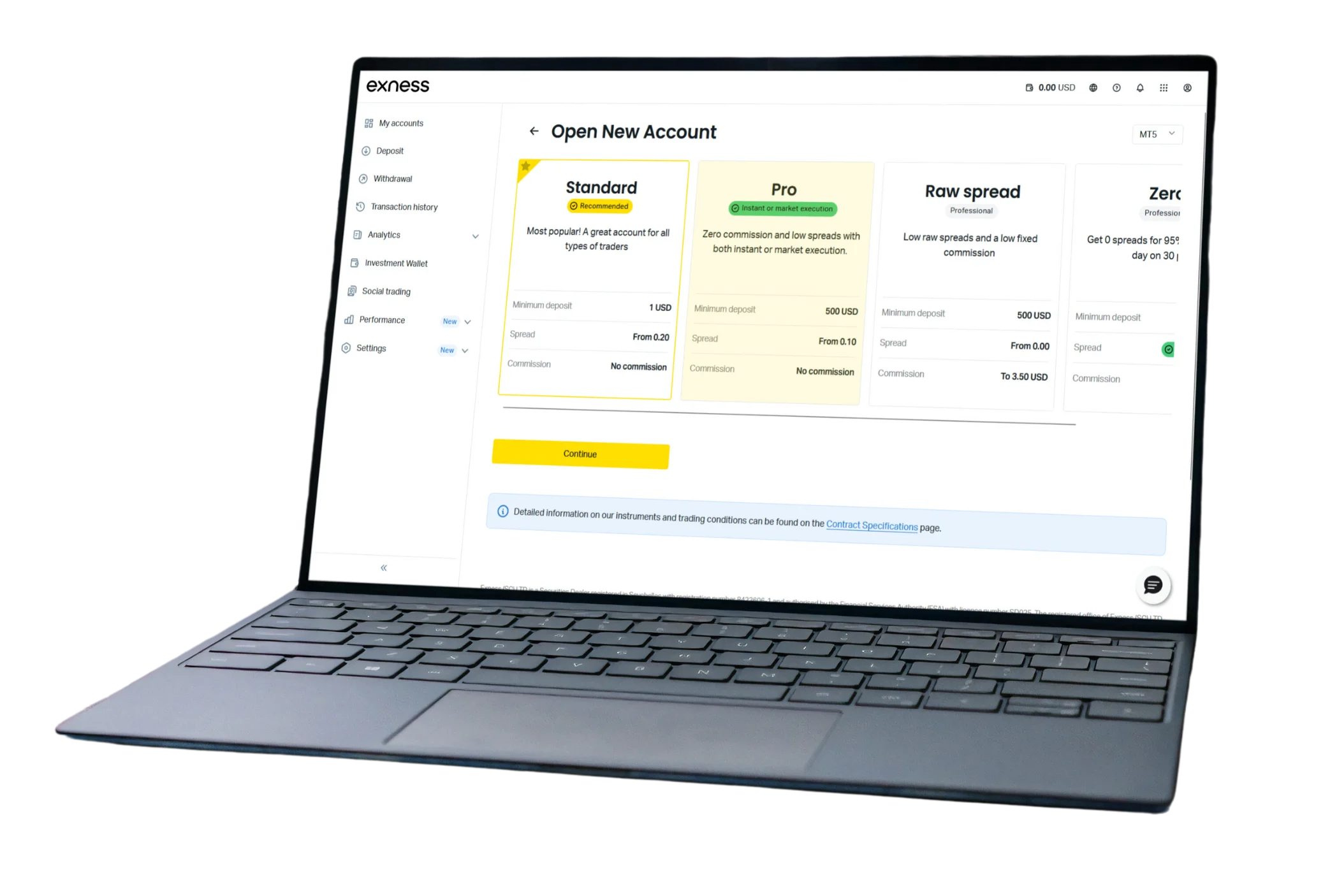

How to Open an Exness Account in India

To open a specific type of trading account with Exness, you’ll need to follow these steps:

1. Check Requirements:

- Age: 18+.

- Documents: PAN card, Aadhaar, passport, or driver’s license (for KYC); utility bill or bank statement (not older than 3–6 months).

2. Register:

- Visit exness.com, click “Register.”

- Enter name, email, phone number (+91), select India, create a password.

3. Verify Details: Confirm email via link and phone number with SMS code.

4. Complete KYC: Log in to Personal Area, upload POI and POR documents. Verification takes up to 24 hours.

5. Choose Account Type: Exness Standard Account, Exness Cent Account, Exness Pro Account, Exness Raw Spread Account, Exness Zero Spread Account

6. Fund Account:

- Go to “Deposit,” choose UPI, net banking, card, or e-wallet (Skrill, Neteller, PayTM).

- Currency: INR (to avoid conversion fees).

- Minimum: $10 for Standard/Cent.

7. Start Trading:

- Download MT4, MT5, or Exness Trader (iOS/Android).

- Log in, set leverage, trade forex, crypto, gold, etc.

Countries Where Exness Is Not Available

Exness provides trading services to many countries around the world, but it’s unavailable in some regions due to regulations or other factors. Here are a few examples of countries where Exness is not available:

- The United States

- Canada

- North Korea

- Syria

If you’re unsure whether Exness operates in your region, it’s best to check directly on the Exness website or contact customer support for clarification.

Exness Account Types Comparison

Exness offers multiple Exness accounts types designed to meet the diverse needs of traders, from beginners to professionals. Understanding the differences between these Exness account types is crucial for selecting the right option for your trading strategy and experience level.

| Feature | Standard | Standard Cent | Standard Plus | Raw Spread | Zero | Pro |

| Minimum Deposit | $1 | $1 | $50 | $200 | $500 | $200 |

| Spreads From | 0.3 pips | 0.3 pips | 0.1 pips | 0.0 pips | 0.0 pips | 0.1 pips |

| Commission | No | No | No | $3.50 per lot/side | No | $3.50 per lot/side |

| Maximum Leverage | 1:Unlimited* | 1:1000 | 1:2000 | 1:Unlimited* | 1:Unlimited* | 1:Unlimited* |

| Execution Type | Instant | Instant | Instant | Market | Instant | Market |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Trade Size | 200 lots | 200 lots | 200 lots | 200 lots | 200 lots | 200 lots |

| Instruments Available | 120+ | 120+ | 120+ | 120+ | 120+ | 120+ |

| Best For | Beginners | Micro trading | Active traders | Scalpers | Professionals | Advanced traders |

How to Choose the Best Exness Account Type

Choosing the right Exness account type is crucial for a successful trading experience. Here are some key factors to consider:

- Trading Experience and Volumes: If you’re a beginner, the Standard or Demo accounts are ideal starting points. As your skills and trade sizes grow, you may want to look at the Professional suite for lower costs.

- Capital Available: Accounts like the Exness Raw Spread Account and Exness Zero Account demand higher minimum deposits. Ensure you have sufficient capital to meet the requirements comfortably.

- Trading Style: If you’re a scalper executing many trades daily, the commission-based Professional accounts can save you significantly versus Standard spreads over time.

- Leverage Needs: Standard accounts permit higher leverage up to 1:Unlimited versus the Professional accounts maxing at 1:2000. Evaluate your leverage requirements.

Overall, take a holistic view considering your skill level, trade volumes, strategy, leverage needs, and available capital. Choosing the right Exness account can enhance your profitability, while the wrong one may be unnecessarily costly.

Exness Spreads by Account Type

Understanding spreads is crucial when choosing your Exness account type. Exness Spreads are the difference between the buy and sell prices of currency pairs. Lower spreads mean lower trading costs.

What affects spreads:

- Market volatility

- Trading session (London and New York sessions typically have tighter spreads)

- Currency pair popularity

- Account type chosen

Exness Standard vs Exness Professional accounts: Standard accounts offer fixed spreads with no commission, making costs predictable. Professional accounts offer variable spreads that can go as low as 0.0 pips but may include commission charges.

Spreads Comparison for Popular Pairs

| Currency Pair | Standard | Standard Cent | Raw Spread | Zero | Pro |

| EUR/USD | 1.0 pips | 0.7 pips | 0.1 pips* | 0.0 pips | 0.2 pips* |

| GBP/USD | 1.5 pips | 0.9 pips | 0.3 pips* | 0.0 pips | 0.4 pips* |

| USD/JPY | 1.1 pips | 0.7 pips | 0.1 pips* | 0.0 pips | 0.2 pips* |

| Gold | 0.30 pips | 0.20 pips | 0.10 pips* | 0.0 pips | 0.15 pips* |

*Plus $3.50 commission per lot per side

Advantages and Disadvantages of Exness Accounts

Exness Standard Account

Advantages:

- Exness Standard account minimum deposit is as low as $1, making it an accessible option for traders starting with a smaller budget.

- Tight spreads from 0.3 pips on major currency pairs

- High leverage up to 1:2000

- No dealing commissions

- Fast market execution

Disadvantages:

- Spreads can get expensive for larger trade sizes compared to commission accounts

Exness Standard Cent Account

Advantages:

- Tiny $0.10 Exness cent account minimum deposit requirement.

- Quotes in cents/micro lots ideal for small accounts

- Same tight spreads and high leverage as regular Standard

Disadvantages:

- Limited base currencies available (USD, EUR only)

Exness Pro Account

Advantages:

- No markups, spreads from 0.1 pips

- Zero commission

- Unlimited leverage

- $200 minimum deposit

Disadvantages:

- Not suitable for beginners

Exness Zero Spread Account

Advantages:

- Zero spread on top 30 instruments

- Spreads from 0 pips on other instruments

- Low $0.05 Exness commission per lot per side.

- Unlimited leverage

- $200 minimum deposit

Disadvantages:

- Commission applies even on zero spread instruments

Exness Raw Spread Account

Advantages:

- Lowest spreads from 0 pips

- Reasonable $3.50 max commission per side per lot

- Unlimited leverage

- $200 minimum deposit

Disadvantages:

- Commission applies to all trades

Exness Islamic (Swap-Free) Account

Advantages:

- No swap/rollover fees for holding positions overnight

- Suits Muslim traders’ requirements

Disadvantages:

- Otherwise same as Standard account pricing/conditions

The key factors are your trading style, capital, volumes, and cost sensitivity. Professional accounts can be very cost-effective for larger trade sizes despite higher minimums. When choosing between different Exness account types, it’s important to consider how each type aligns with your trading preferences and goals. For example, certain accounts may offer lower spreads or better leverage options, making them more suitable for high-volume traders. Understanding the nuances of Exness accounts will help you optimize your trading experience and manage costs effectively.

FAQs

What is the difference between Raw Spread and Zero accounts?

Raw Spread offers spreads from 0.0 pips with a fixed $3.5 commission per lot per side. Zero has zero spreads on top 30 instruments for 95% of the day with commissions from $0.2 per side per lot, varying by instrument. Both use market execution, no requotes, and support forex, metals, crypto, energies, stocks, and indices.