How Margin Works

Margin is the money you need in your account to open a trade with borrowed funds. It’s a deposit that lets you control bigger trades than your balance allows.

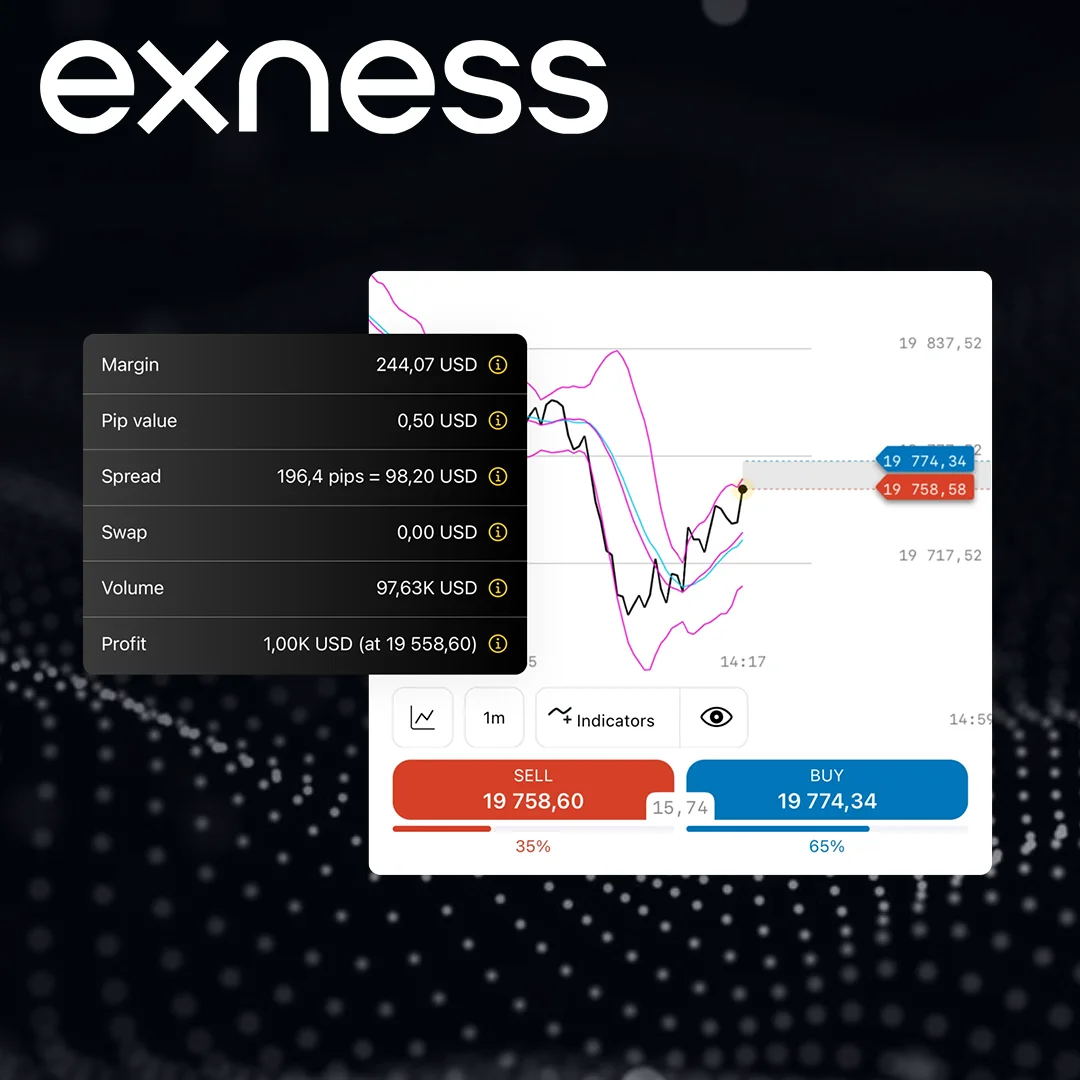

Exness offers a margin calculator on its website and Windows App to help Indian traders figure out how much money is needed for trades. You enter your account type, trade size, and leverage, and it shows the margin required for assets like USD/INR or stocks. For example, trading 1 lot of EUR/INR with 1:50 leverage needs less margin than with 1:10. This tool helps avoid margin calls by showing how much capital to keep free. Practice with the calculator in a demo account to plan trades without risking real funds.

Leverage lowers the margin needed for trades, letting Indian traders open larger positions with less money, but it also raises the risk of bigger losses. For example, with 1:100 leverage, a $500 account can control $50,000 in trades, needing less margin than 1:20 leverage. High leverage on INR pairs like USD/INR can lead to quick losses if the market moves against you. Start with lower leverage (1:20 or 1:50) for safer trading and test different settings in a demo account to understand their impact.

Leverage Options for India

Exness offers Indian traders leverage from 1:2 to 1:2000, and even unlimited leverage for eligible accounts, to trade INR-based pairs like USD/INR. Higher leverage reduces margin needs but increases risk, so it’s crucial to comply with RBI and SEBI rules. Use Exness’s tools to manage leverage wisely and stay within legal limits.

Unlimited Leverage Unlocked

Unlimited leverage on Exness allows Indian traders to open large positions with minimal margin. It’s available on select accounts under specific conditions.

- Equity: Account equity must be under USD 1,000.

- Trading History: Close at least 10 positions (excluding pending orders) and trade 5 lots across all real accounts.

- Account Types: Available on Standard, Standard Cent, Standard Plus, Pro, Raw Spread, and Zero accounts.

- Activation: Select unlimited leverage in your Exness Personal Area once conditions are met.

This option suits experienced traders but carries high risks. Practice in a demo account to test strategies before using unlimited leverage.

Preventing Margin Calls

A margin call happens when your account’s equity falls below the required margin, risking automatic closure of trades. To avoid this, Indian traders should monitor margin levels closely and use low leverage (e.g., 1:20 or 1:50) for INR pairs like USD/INR, especially during volatile market hours. Set stop-loss orders to limit losses and keep enough free margin to cover price swings. Exness’s real-time margin updates help you stay informed.

High leverage, like 1:2000, reduces margin needs but makes margin calls more likely if the market moves against you. Regularly check your account’s margin level (equity divided by used margin, multiplied by 100%) and add funds if it drops below 200%. Using Exness’s margin calculator before trading helps plan safe position sizes. Practice risk management in a demo account to avoid surprises.

Stay Safe with Risk Tools

Exness provides stop-loss orders and margin alerts to help Indian traders manage risks effectively. These tools are essential for trading INR pairs safely within FEMA guidelines.

Stop-Loss

A stop-loss order automatically closes a trade at a set price to limit losses. It’s a key tool for Indian traders to protect funds during market swings.

- Open the Exness Windows App or MT4/MT5 platform.

- Select your trade and click “Modify” or “Set Order.”

- Enter the stop-loss price (e.g., 1.2 pips below current price for USD/INR).

- Confirm the order to activate the stop-loss.

Set a stop-loss at 83.50 for a USD/INR buy at 83.62 to cap losses. Practice setting stop-loss in a demo account to find optimal levels.

Margin Alerts

Exness’s margin alerts notify Indian traders when their account’s margin level nears critical thresholds, helping prevent margin calls or stop-outs. Available on the Windows App, MT4, or MT5, these alerts can be set to trigger at specific levels, like 200% or 100%, via email or push notifications. During volatile Indian trading hours (9:15 AM to 3:30 PM IST), alerts help you act fast—adding funds or closing trades. Check your margin level regularly in the app’s account overview, and practice responding to alerts in a demo account to build discipline.

Tips for Smart Trading

Use Exness’s demo account and risk tools to trade INR pairs wisely. Start with low leverage and small positions to minimize risks while learning.

Exness’s demo account lets Indian traders practice margin trading without risking real money, ideal for testing leverage and strategies on INR pairs like USD/INR. Available on the Windows App, MT4, or MT5, it mirrors live market conditions, letting you experiment with leverage settings (e.g., 1:50 vs. 1:200) and stop-loss orders. For example, try trading 0.1 lots of EUR/INR to see how leverage affects margin. Spend at least a month in demo mode to build confidence, track performance, and refine your approach before going live. This practice helps you understand market moves and avoid legal issues with non-INR pairs.

To prevent big losses, Indian traders should use conservative leverage (1:20 or 1:50) and set stop-loss orders on every trade, especially for volatile INR pairs. High leverage like 1:2000 can lead to rapid losses if the market shifts, so keep position sizes small relative to your account balance (e.g., 1-2% risk per trade). Monitor economic news, like RBI policy updates, which can spike volatility in USD/INR. Practice in a demo account to test risk limits and use Exness’s margin calculator to ensure you have enough capital to avoid forced closures.

Managing Volatility in Indian Trading Hours

Indian trading hours (9:15 AM to 3:30 PM IST) can be volatile for INR pairs due to local economic news and global market overlaps. Exness tools help manage these fluctuations effectively.

- Check Economic Calendar: Review Exness’s calendar for RBI announcements or global events affecting USD/INR.

- Lower Leverage: Use 1:20 or 1:50 during high-impact news to reduce margin risks.

- Set Alerts: Enable margin and price alerts in the Exness app for real-time updates.

- Use Stop-Loss: Apply tight stop-loss orders to limit losses during sudden price moves.

Volatility spikes often occur around 2:00 PM IST during U.S. market openings. Practice trading these hours in a demo account to master risk control.

FAQs

What is margin trading with Exness in India?

Margin trading with Exness allows Indian traders to borrow funds to trade larger positions in forex, stocks, or cryptocurrencies, focusing on INR-based pairs like USD/INR, using less of their own money.