The Exness Social Trading platform is a revolutionary tool that allows traders to follow and copy the strategies of experienced professionals. By relying on the expertise of seasoned traders, beginners can capitalize on market opportunities without needing to conduct complex analysis. This guide breaks down how Exness Social Trading works, highlights its key benefits, and offers tips for using the platform effectively.

What is Exness Social Trading?

Exness Social Trading enables users to automatically replicate the trades of expert traders, often referred to as strategy providers. It’s a straightforward way for beginners to participate in the markets while learning from professionals.

Key Terms

- Drawdown: The maximum drop in account balance from its peak.

- Social Trading: Copying trades from skilled traders directly to your account.

- Strategy Provider: An experienced trader sharing their strategies.

- Copy Trader: A user replicating trades from a strategy provider.

- Profit Sharing: The percentage of profits shared with the strategy provider.

- Risk Level: Represents the level of risk associated with a trading strategy.

Main Features of Exness Social Trading

Exness Social Trading is designed for simplicity and effectiveness, benefiting traders of all skill levels.

| Feature | Benefit | Description | Example of Use |

| Real-Time Copying | Ensures precise trade replication. | Trades are instantly copied from strategy providers to followers. | Following a high-performing trader during volatile markets. |

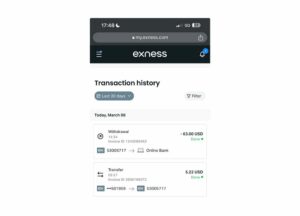

| Mobile Access | Trade and monitor on the go. | Full functionality on iOS and Android apps. | Tracking copied trades while traveling. |

| Customizable Risk Levels | Allows users to control exposure. | Adjust risk settings to match your trading preferences. | Lowering risk by copying trades at reduced ratios. |

| Profit Sharing | Motivates experts to share successful strategies. | Providers earn a share of profits from followers. | A provider earns 20% of follower profits. |

| Detailed Performance Metrics | Helps users make informed decisions. | Provides stats on provider performance, risk, and drawdown. | Reviewing historical performance before copying. |

These features make Exness Social Trading ideal for those seeking a convenient way to enter the markets. By selecting strategy providers with proven success, you can potentially grow your returns while keeping risks manageable.

How to Get Started with Exness Social Trading

- Create an Exness Account. Visit Exness and register for a trading account.

- Access the Social Trading Platform. Log in and go to the “Social Trading” section.

- Select a Strategy Provider. Browse providers based on performance, risk level, and profit-sharing percentage.

- Evaluate Performance Metrics. Review the provider’s historical returns, drawdowns, and risk levels before making a selection.

- Allocate Funds and Adjust Risk. Choose how much capital to invest and set risk preferences based on your comfort level.

- Monitor and Make Adjustments. Regularly review your trades and refine your strategy as needed.

Comparing Exness Social Trading Against Competitors

| Feature | Exness Social Trading | eToro | ZuluTrade |

|---|---|---|---|

| Minimum Deposit | $500 | $200 | $300 |

| Profit Sharing | Yes (15%-30%, based on provider performance) | No (built into spread/commission) | Yes (up to 20%, depending on provider terms) |

| Platform Fees | None | 1% withdrawal fee | Varies by broker; may include additional commission fees |

| Copy Delay | Less than 1 second | 1-3 seconds | 2-5 seconds |

| Mobile Access | Fully functional iOS and Android apps available | Supports trading and monitoring on iOS and Android | Mobile apps for iOS and Android with comprehensive features |

| Risk Management Tools | Adjustable risk levels for personalized exposure control | Fixed allocation; risk is pre-set | Customizable stop levels to manage individual trades |

| Providers Available | 100+ active strategy providers | 10,000+ including a wide variety of assets | 5,000+ with focus on Forex and diversified strategies |

| Verification | Mandatory account verification for all users | Verification required only for withdrawals | Account verification necessary for all users |

| Assets Offered | Forex, Cryptos, Commodities, Indices, and more | Stocks, Forex, Cryptos, ETFs | Primarily Forex, Cryptos, and Commodities |

Key Takeaways

- Exness Social Trading: Focused on delivering low-latency copying and a profit-sharing model that encourages high-performing strategy providers. Ideal for traders looking for Forex, crypto, and commodity exposure with flexible risk settings.

- eToro: A great choice for those looking to build a diverse portfolio in stocks and equities. Offers commission-free trades on some assets but includes withdrawal fees.

- ZuluTrade: Well-suited for Forex traders seeking customizable risk controls and diverse provider strategies. However, platform fees and commissions may vary depending on the broker.

Best Practices for Choosing a Strategy Provider

Tip: Review Historical Performance

Why It’s Important: Analyzing past performance helps you evaluate how consistent the provider has been in generating profits and managing risks.

Example: Select providers who have demonstrated steady growth and reliable returns over time.

Tip: Check Drawdown

Why It’s Important: The drawdown reveals the maximum losses a provider has experienced, helping you gauge their risk level.

Example: Steer clear of providers with unusually high drawdowns, as they may pose greater risks.

Tip: Diversify Among Providers

Why It’s Important: Diversification helps you minimize risk by allocating your funds across several strategies instead of relying on just one.

Example: Follow and copy trades from 3–5 different strategy providers to spread your exposure.

Tip: Adjust Risk Levels

Why It’s Important: Customizing risk settings allows you to manage how much you’re willing to risk in volatile markets.

Example: When testing a new provider, start with lower risk ratios to limit potential losses.

Tip: Monitor Regularly

Why It’s Important: Regularly tracking performance ensures your trading approach stays in line with the latest market trends.

Example: Assess the provider’s performance weekly and make adjustments as needed.

Key Metrics in Social Trading

| Metric | Description | Impact on Copy Trading | Additional Insights |

|---|---|---|---|

| Profit Sharing | The percentage of your profits shared with the strategy provider as a fee for their services. | Higher profit-sharing rates mean reduced net earnings for you. However, providers with exceptional performance may justify these costs. | Consider providers with competitive profit-sharing rates that balance costs and high-quality strategies. |

| Risk Level | Indicates the aggressiveness of a provider’s trading strategy. | High-risk strategies may yield larger profits but also pose a higher chance of significant drawdowns. | Assess risk levels against your tolerance and avoid overly aggressive strategies if you prefer stability. |

| Average Trade Duration | Reflects the average time a provider holds trades before closing. | Shorter durations are better for day trading or scalping, while longer durations align with swing or position trading strategies. | Look for durations that match your preferred trading style and schedule. |

| Win Rate | The percentage of profitable trades out of the total trades executed by the provider. | A high win rate doesn’t guarantee high profits. Providers with fewer but larger winning trades might outperform those with high win rates and small profits. | Analyze win rates alongside other factors like drawdowns and average profit per trade. |

| Followers’ Capital | The total funds allocated to the provider by their followers. | A higher amount of follower capital often indicates reliability and trustworthiness in the provider’s performance. | Providers with large capital backing are more likely to deliver consistent results, but still check metrics like drawdowns. |

This detailed table allows for a comprehensive understanding of social trading metrics while helping you make more informed decisions. Consider not just individual metrics but how they work together to reflect the provider’s overall strategy.

Evaluating and Managing Risk in Social Trading

| Risk Factor | Description | Suggested Action | Additional Insights |

|---|---|---|---|

| High Drawdown | Represents the largest loss recorded in the provider’s trading account. | Prioritize providers with historically low drawdowns to minimize exposure to large losses. | A lower drawdown indicates better risk management and more consistent trading strategies. |

| Inconsistent Profits | Reflects fluctuating monthly returns, which may indicate poor or unstable risk management. | Spread your investments across several providers to reduce dependency on a single strategy. | Diversification is key to minimizing risks caused by unstable performance from individual providers. |

| High Profit Sharing | Shows the percentage of your profits allocated to the provider as a fee for their service. | Focus on providers who offer competitive profit-sharing terms without compromising performance quality. | A balance between fair profit-sharing and high-quality strategies is essential for maximizing net returns. |

| Short Account Age | Indicates that a provider has not been active long enough to prove the reliability of their strategy. | Look for accounts with a trading history of at least 12 months to ensure their strategies are tested over time. | Experienced providers are more likely to have faced and adapted to different market conditions. |

| Low Number of Trades | Suggests the provider executes trades infrequently, leading to potentially inconsistent results. | Choose providers with higher trading activity to ensure consistent opportunities for returns. | Frequent trades often indicate active engagement and better adaptability to market changes. |

This table provides a structured way to analyze potential risks in social trading and suggests practical steps to manage them effectively. By combining these insights with regular monitoring of your portfolio, you can enhance your trading outcomes while minimizing unnecessary exposure to risk.

Conclusion

The Exness Social Trading platform is an excellent tool for those looking to leverage the knowledge of experienced traders. By carefully selecting strategy providers and applying proper risk management, you can enhance your returns while reducing exposure to market fluctuations. Use the insights and strategies shared in this guide to optimize your social trading experience.

Trade with trusted broker Exness today

See for yourself why Exness is the preferred broker of over 800,000 traders and 64,000 partners.

Frequently Asked Questions (FAQs)

Is Exness Social Trading free to use?

Yes, the platform is free, but strategy providers take a portion of the profits (profit sharing).