Overnight fees (also called swap points or rollover costs) are an important trading expense that affects anyone keeping positions open overnight. At Exness platform, these fees change based on interest rate differences, market situations, and what you’re trading. Knowing how these fees work, where to find them, and how to handle them better can really help your trading profits.

What Are These Overnight Fees?

A swap is a charge or payment applied when you keep a trade open past the daily cutoff time. It’s figured out using the difference between interest rates of two currencies in forex trading, or the cost of funding for CFDs.

Main Things That Change Swap Rates

Interest Rate Differences: Each currency pair has two currencies, and their central bank rates determine if you pay or get paid for overnight positions. For example: If you buy EUR/USD and the Euro has a higher interest rate than the US dollar, you might receive money instead of paying fees.

Market Flow & Movement: Swap rates change with market supply and demand. When markets are jumpy, swap rates can change a lot.

What You’re Trading: Currency pairs, metals, crypto, stock indexes, and company stocks all have different swap structures. Less common currency pairs usually have higher swap costs because fewer people trade them.

Broker Markup: Trading companies add their own markup to the swap rate, which is why different brokers charge different amounts for the same instrument.

Weekend Adjustment (Triple Wednesday Swaps): Since forex markets close on weekends but interest still applies, Exness charges three times the normal swap on Wednesday nights.

How to See Swap Rates on Exness

Exness gives you several ways to check current swap rates so you can figure out your overnight costs:

Looking Up Swaps in MT4 & MT5

The quickest way to see swap rates right in your trading platform:

1. Open MT4 or MT5 and log into your Exness account

2. Open Market Watch (Press Ctrl + M if you don’t see it)

3. Right-click the trading pair (like EUR/USD) and pick “Specifications”

4. A window will open showing:

- Swap Long: Fee for keeping a buy position

- Swap Short: Fee for keeping a sell position

Helpful Tip: If both long and short swaps show negative numbers, you’ll pay fees either way. If one side shows a positive number, you can actually earn money holding that position overnight.

Finding Swap Rates on the Exness Website

You can check the most current swap rates directly on the Exness main website:

- Visit the Exness site and sign into your Personal Area

- Click on “Trading” and then “Contract Specifications”

- Find and click the trading pair you want to check

- Look down the page until you see swap rates for both long and short positions

Why look on the website?

- Swap rates change with market conditions

- The website shows the newest rates right away

Checking Swaps in Your Exness Account Area

Your account dashboard also shows trading costs for your specific account:

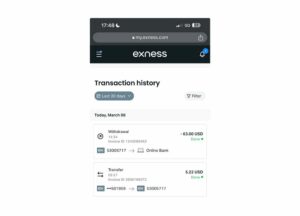

- Log into your Exness account through the Personal Area

- Choose which trading account you want to check

- Look for swap information under your account settings

Remember:

- Different account types may have different swap rates

- Professional-level accounts often have their own swap fee structure

No-Swap (Islamic) Accounts at Exness

Exness offers no-swap accounts for traders in certain regions or those who want to avoid interest-based fees.

How No-Swap Accounts Work:

- No swap fees on open positions

- Instead, Exness might charge a set overnight fee depending on what you’re trading

- Only available for traders from certain countries (mostly Islamic regions)

Getting a No-Swap Account:

- Go to your Personal Area and choose an eligible account

- See if no-swap trading is available (depends on where you live)

- Turn on no-swap trading

- Check with Exness Support if you need more verification

Important: Not all Exness trading instruments are free from fees. Some uncommon pairs and commodities might still have charges.

Example of Swap Calculation

Swaps can either cost you money or earn you money depending on what you’re trading and which direction. Here’s an example showing how Exness swap charges work:

Keeping a EUR/USD Buy Position Overnight

Trade Details:

- Instrument: EUR/USD

- Position: Buy (Long)

- Size: 1 Lot (100,000 units)

- Swap Long: -0.50 pips (negative)

- Swap Short: +0.30 pips (positive)

Math:

- Swap = Swap Rate (in pips) × Lot Size × Pip Value

- Swap = -0.50 × 100,000 × 0.0001

- Swap = -$5 per night

If you keep this position for 3 nights, you’ll pay $15 total. If one of those nights is Wednesday, you’ll pay $15 just for that night (triple charge).

Holding a Short Position on Gold (XAU/USD)

Trade Information:

Asset: Gold (XAU/USD)

Trade Type: Sell (Short)

Volume: 1 Lot (equals 100 ounces)

Short Swap Rate: +1.25 USD

How It’s Calculated:

Swap Fee = 1.25 × 100

Total Swap = $125 per night

Summary:

By keeping this short position open overnight, the trader gains $125 daily.

Ways to Lower Swap Costs and Improve Your Trading

Swaps affect your profits, but you can reduce costs or even turn them into an advantage:

- Trade with positive swaps – Open positions where you get paid instead of charged

- Close trades before the daily cutoff (00:00 server time) – Avoid the charge completely

- Use no-swap accounts – If available to you, this removes overnight interest costs

- Choose instruments with low swap charges – Some pairs cost much less to hold overnight

Final Thoughts

Swap fees are a key cost for traders. Understanding Exness swap points and checking them regularly helps you plan better strategies. By using positive swaps, closing trades at smart times, or using no-swap accounts when possible, you can reduce costs and improve your trading results.

Always check the latest swap rates on Exness platforms or website to avoid surprises.

Trade with a trusted broker Exness today

Join over 800,000 traders and 64,000 partners who choose Exness.