Neteller stands out as one of the best e-wallets for Exness traders. It’s fast, safe, and doesn’t cost much to use. You can put money in and take it out quickly, which means you can start trading sooner. This guide will show you exactly how to use Neteller with your Exness account. I’ll cover how long transactions take, what limits apply, any fees you might face, and how to fix common problems.

Traders around the world like Neteller because it works in many countries and has good security. But you need to know exactly how to use it with Exness to avoid problems. I’ve included clear steps, information about fees, and fixes for common issues below.

Adding Money to Exness via Neteller

Putting money into your Exness account using Neteller is quick and easy. Most deposits show up right away. Exness won’t charge you extra fees for using Neteller, which saves you money. Just make sure the name on your Neteller account matches your Exness account, or your deposit might fail.

Neteller works with many different currencies, so you often won’t need to pay to convert your money. It’s a good idea to verify your Neteller account before you start. Here’s how to add funds to your Exness account:

Step-by-Step Deposit Guide

1.Sign in to Exness

- Go to the Exness website and log in

- Make sure your account is verified to avoid deposit problems

2. Find the Deposit Option

- Click “Deposit” on your dashboard

- Choose “Neteller” from the payment methods

3. Fill in Your Deposit Information

- Select which trading account you want to fund

- Enter how much you want to deposit (there are minimum and maximum amounts)

- Remember that if your currencies don’t match, you might pay conversion fees

4. Confirm on Neteller

- You’ll be sent to Neteller’s login page

- Enter your Neteller login details and approve the payment

5. Check Your Deposit Went Through

- Go back to Exness

- Look at your account balance to make sure the money arrived

Important Things to Know About Deposits

- You must deposit from a Neteller account with the same name as your Exness account

- Deposits usually happen instantly, but sometimes take a few minutes

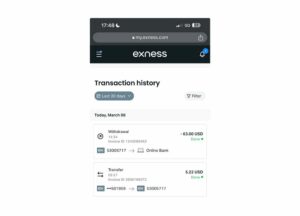

- If you don’t see your deposit right away, check your Neteller history before contacting support

Taking Money Out of Exness Using Neteller

Withdrawing money from Exness using Neteller is fast and works well. Most withdrawals are processed within 24 hours. This is much quicker than regular bank transfers, which can take several days. You must withdraw to the same Neteller account you used for deposits, which is part of Exness’s security rules.

Your withdrawal must follow both Exness and Neteller limits. Before withdrawing, verify your accounts and check that your personal details match on both platforms. Here’s how to get your money out:

Step-by-Step Withdrawal Guide

1.Log into Your Exness Account

- Enter your login details on the Exness site

- Check that your account is fully verified to prevent withdrawal problems

2. Go to Withdrawals

- Click on “Withdrawal” in the menu

- Select “Neteller” as your withdrawal method

3. Enter Your Withdrawal Details

- Choose which trading account to withdraw from

- Enter the amount (minimum and maximum limits apply)

- Type in the email address linked to your Neteller account

4. Review and Submit

- Double-check all information to avoid mistakes

- Submit your request and enter any verification codes if asked

5. Wait for Processing

- Withdrawals usually take a few hours but might take up to 24 hours

- Once approved, check your Neteller balance to confirm the money arrived

Important Things to Know About Withdrawals

- Withdrawals must go to the same Neteller account you used for deposits

- Processing times can change based on Neteller’s policies and verification needs

- Some regions have specific withdrawal restrictions, so check with Neteller if you have problems

Neteller Fees and Limits on Exness

Exness doesn’t charge extra fees for Neteller deposits or withdrawals, which makes it a good choice for traders. But Neteller might charge its own fees depending on your account type, where you live, and whether you need to convert currencies.

| Transaction | Minimum Amount | Processing Time | Exness Fees | Maximum Amount |

| Deposit | Varies by region | Instant | 0%* | Based on account limits |

| Withdrawal | $10 | Up to 24 hours | 0%* | Based on account limits |

*Exness doesn’t charge fees, but Neteller might charge fees based on where you live and what type of account you have.

Other Possible Neteller Fees

- Neteller might charge a percentage fee if you need to convert currencies between your Exness and Neteller accounts

- If you don’t use your Neteller account for a long time, they might charge an inactivity fee

- International transactions might have extra processing fees based on Neteller’s rules

Common Problems and Solutions

While Neteller is reliable, sometimes things go wrong with transactions. Most problems happen because of wrong account details, going over limits, or processing delays.

| Problem | Possible Cause | Solution |

| Deposit not showing up | Neteller processing delay or wrong details | Wait a few minutes, check your Neteller transaction history, and verify your details |

| Withdrawal taking too long | Processing queue or unverified Neteller account | Allow up to 24 hours, check if your Neteller account is verified, and contact support if needed |

| Transaction rejected | Not enough money in Neteller | Make sure you have enough funds in your Neteller account |

| Exceeded limits | Reached Exness or Neteller transaction limits | Change withdrawal amount, verify your Neteller account to increase limits |

How to Avoid Problems with Neteller Transactions

- Make sure your Neteller account is verified before making deposits or withdrawals

- Use the same email for both Exness and Neteller to avoid rejections

- Check Neteller’s daily limits before trying large withdrawals

- Be aware of Neteller fees and possible conversion charges if using different currencies

Benefits of Using Neteller with Exness

Neteller has several advantages over regular banking and other e-wallets. It offers instant deposits, fast withdrawals, and good security, making it a great choice for traders.

Main Benefits

- Instant Deposits – Your money is available right away for trading

- Fast Withdrawals – Usually processed within 24 hours

- No Exness Fees – Exness doesn’t charge for Neteller transactions

- Available Worldwide – Neteller works in over 200 countries

- Safe Transactions – Encrypted payments with two-factor authentication

- Multiple Currency Support – Reduces conversion costs for international traders

Conclusion

Neteller is a trustworthy and efficient payment method for Exness traders. It’s fast, secure, and cost-effective. By understanding how deposits and withdrawals work, what fees might apply, and how to solve common problems, you can manage your trading funds easily and avoid unnecessary delays.

Trade with a trusted broker Exness today

Join over 800,000 traders and 64,000 partners who choose Exness.