Exness minimum deposit is the minimum amount you need to fund your trading account. The good news is that Exness does not have a fixed minimum deposit for all account types. Instead, the minimum deposit depends on the payment method you choose and the type of account you open. This means that you can start trading with Exness with $1 or less.

However, the minimum deposit is not the only factor you should consider when selecting a broker. You also need to consider trading conditions, such as spreads, commissions, leverage, instruments and execution. In the following sections, we will show you how to choose the best deposit method and account type for your trading needs.

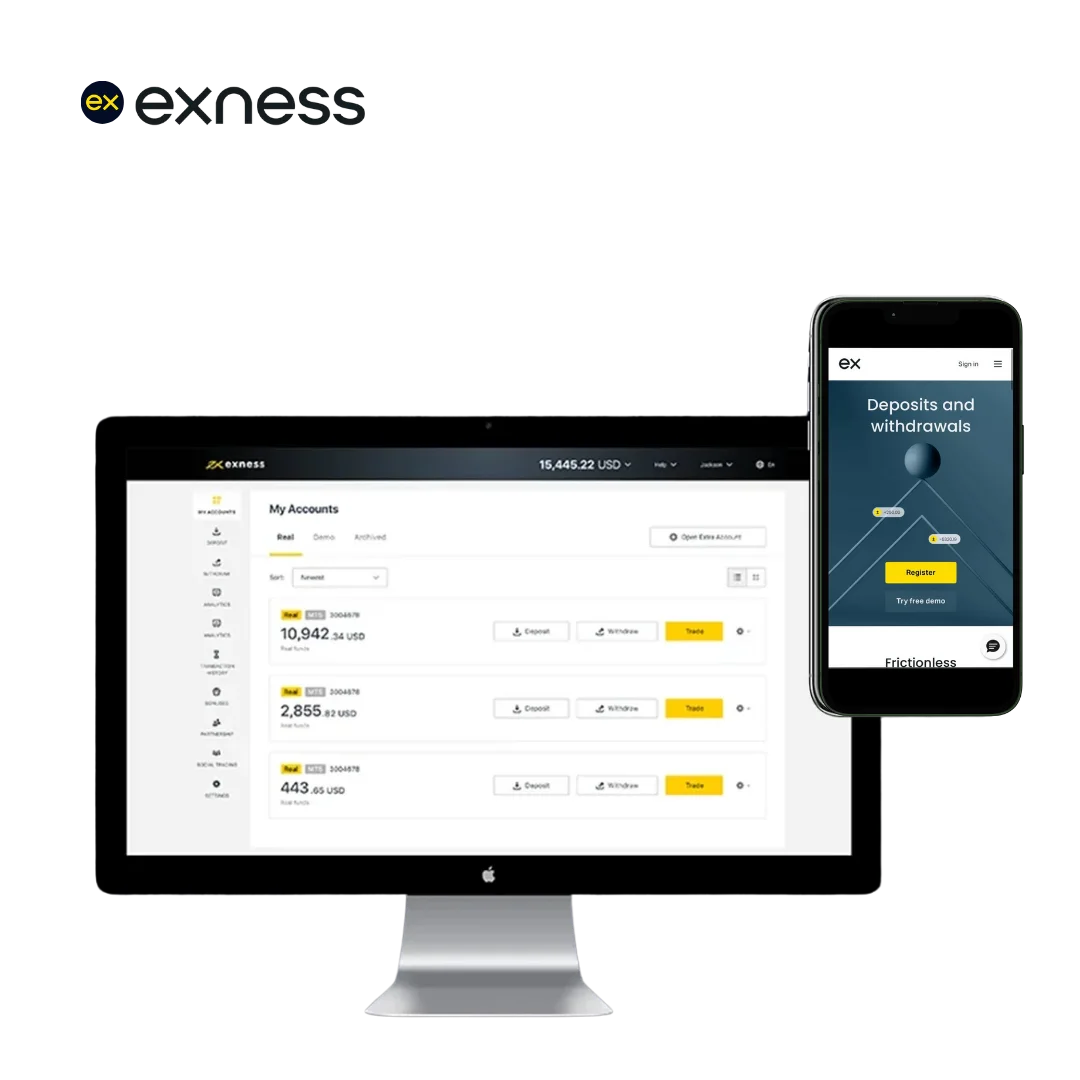

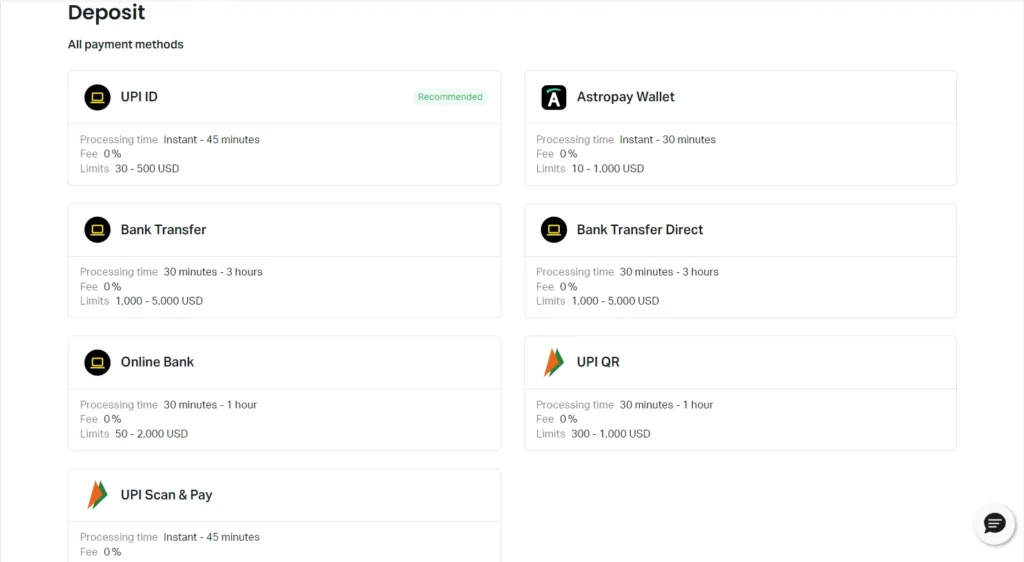

Exness Deposit Methods

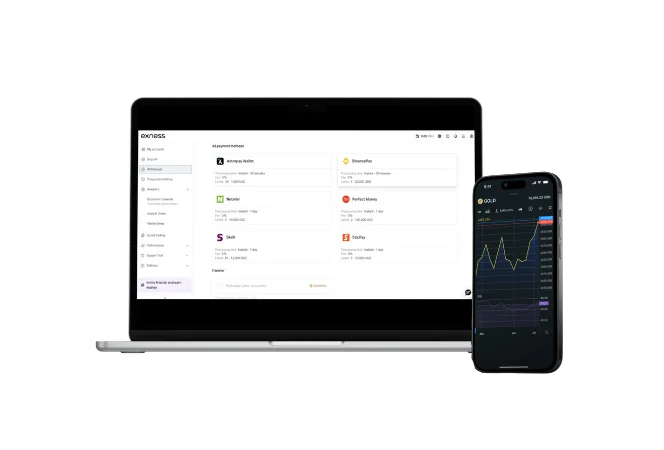

Exness offers various deposit methods, including bank cards, bank transfers, e-wallets and cryptocurrencies. Each method has its own advantages and disadvantages, such as speed, fees, availability, and security. Popular options include:

- Bank cards:

Convenient and fast, with instant deposits and debits, but potential fees and card verification required.

- Bank Transfer:

Secure and traceable, but slow due to bank processing times, with potential bank fees.

- E-Wallets:

Fast and easy, with instant or fast deposits, but require account creation and identity verification, and possible e-wallet or Exness fees.

- Cryptocurrency:

Innovative and private, using decentralized networks, but potentially unstable cryptocurrency networks or fees from Exness.

Exness Minimum Deposit Dependent on Payment Method

As we mentioned earlier, the Exness minimum deposit depends on the funding method you choose. This means that some methods may allow you to deposit less money than others. For example, you can deposit as little as $0.01 with Perfect Money, but you need to deposit at least $3 with Visa or MasterCard.

To help you choose the best Exness funding method for your trading needs, we have prepared a table showing the minimum deposit amounts for each method. Please note that these amounts are subject to change and may vary depending on your country and currency. Therefore, you should always check the latest information on the Exness website or in your personal area.

- Visa – $3

- Skrill – $10

- Perfect Money – $0.01

- Bank Transfer – $50

- Bitcoin – $10

- Mastercard – $3

- Neteller – $10

- Fasapay – $1

- Webmoney – $10

Minimum Deposit in Exness in India

For Indian traders to get started with Exness, the minimum deposit depends on your chosen payment method and account type. Exness does not have a set minimum deposit, allowing you to start trading with $10 or less. However, while the minimum deposit is important, it is not the only consideration.

Factors like spreads, commissions, leverage, instruments and execution also play a decisive role in selecting a broker. Exness offers the UPI Pro method, ideal for Indian traders, which allows easy, fee-free deposits and withdrawals with a minimum of $10. To use UPI Pro, you will need a verified Exness account, a UPI app like Google Pay, and a unique UPI ID.

Exness also supports other deposit methods including bank cards, bank transfers, e-wallets and cryptocurrencies, each with their own advantages and disadvantages. To make an informed choice, compare different methods based on speed, fees, availability, and security. Detailed information can be found on the Exness website or in your personal area.

Minimum Deposits for Different Account Types for Exness

Exness has five account types: Standard, Standard Cent, Pro, Zero and Raw Spread. They differ in spreads, commissions, leverage, instruments and execution. You should choose the one that suits your trading needs.

Exness’s minimum deposit depends on the payment method and region. Generally, Standard and Standard Cent have no set minimum deposits, while Pro, Zero and Raw Spread require at least $200 for a first-time deposit. Here is a summary of the minimum deposits for each account type for Exness:

Standard Account

Ideal for beginners and experienced traders. Market execution, fixed spreads, no commissions, and unlimited leverage. The minimum deposit varies by payment method, but can be as low as $1.

Standard Cent Account

Same as Standard, but for micro lots (0.01 of a standard lot). The minimum deposit is even lower, starting at $0.01 with Perfect Money.

Pro Account

For professional traders who want low spreads, high leverage and fast execution. It charges $3.5 per side per lot, but gives the option of more instruments such as stocks and indices. The minimum first-time deposit is $200, but may vary by region.

Zero Account

For advanced traders who want zero spreads, high leverage and market execution. It charges $3.5 per side per lot, but offers the best prices and liquidity. The minimum first-time deposit is $200, but may vary by region.

Raw Spread Account

For experienced traders who want extremely low, stable spreads. It charges a fixed commission per lot, which depends on the instrument. The minimum first-time deposit is $200, but may vary by region.

Commission on Exness Deposits

Exness does not charge any fees or commissions on deposits. However, your bank card provider, bank or payment system may apply a transaction fee or commission beyond the control of Exness. Therefore, you should check the terms and conditions of your payment method before making a deposit.

Some payment methods may also have a currency conversion fee, which applies when you deposit or withdraw funds in a currency different from the currency of your account. For example, if you deposit USD into your EUR account, you may have a currency conversion fee applied to your payment method. You can avoid this fee by choosing a payment method that supports your account’s currency.

Here’s an expanded table with additional information on Exness deposit options:

| Deposit Method | Commission | Processing Time |

|---|---|---|

| Bank Transfer | $0 | 3-5 business days |

| Credit/Debit Card | $0 | Instant |

| Skrill | $0 | Instant |

| Neteller | $0 | Instant |

| Cryptocurrency | $0 | Up to 72 hours |

How Long Does a Deposit Take?

Deposit speed depends on the payment method you choose. Some payment methods are faster than others, and processing times for some may vary depending on region and currency. Therefore, you should check the speed of your payment method before making a deposit.

Generally, most payment methods offer quick or instant deposits, which means funds are credited to your Exness account within a few seconds or minutes. However, some payment methods may take longer, such as bank transfers, which may take up to 3-5 business days depending on bank processing times.

Which Currencies Are Accepted for Deposits at Exness?

Exness accepts deposits in different currencies, depending on the payment method and region. You can choose from major currencies, such as USD, EUR, GBP, JPY and BTC, as well as local currencies such as INR, IDR, THB and ZAR. However, you should note that if your deposit currency does not match the currency in your trading account, you may face currency conversion fees from your payment method or Exness. Therefore, it is advisable to choose a payment method that supports the currency of your account.

How to Make Minimum Deposit With Exness

To make a minimum deposit with Exness, you need to follow these steps:

- Log in to your personal area on the Exness website.

- Go to the Deposit section and choose a payment method. You can see the minimum and maximum deposit amount, processing time, and fees for each method.

- Select the trading account you wish to deposit funds into. You can also create a new Exness account if needed.

- Enter the amount and currency of your deposit and click Next. You will see a summary of your deposit details and the exchange rate if applicable.

- Confirm your deposit and follow the instructions for your payment method to complete the transaction. You will receive a confirmation email upon the success of your deposit.

Questions to Ask

Are there any commission-free deposits on Exness?

Exness does not charge any fees or commissions on deposits. However, your payment method may impose certain charges beyond the control of Exness.