Introduction to MetaTrader 4

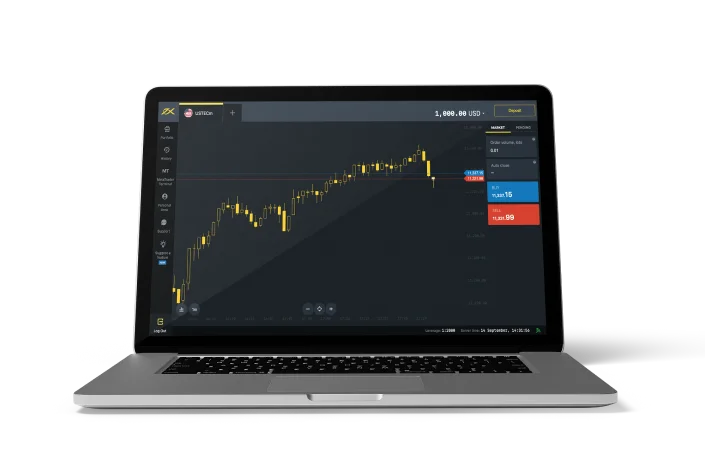

MetaTrader 4, often abbreviated as MT4, has established itself as a cornerstone in the field of online trading. Developed by MetaQuotes Software in 2005, this platform quickly attracted the attention of global traders due to its innovative features and reliable performance.

MT4 offers a trading environment that is suited for both beginners and seasoned traders. It comes with powerful trading and analytical tools to facilitate effective trading in various markets, such as Forex, Textiles, and Indices. Its special ability to support automated trading through Expert Advisors (EAs) sets it apart from many platforms, giving users the ability to create customized trading strategies. If you’re looking to start trading on this versatile platform, you can easily download Exness MT4 from the official Exness website to begin your trading journey.

Many brokers include MT4 in their offering, and Exness stands out among them. Through Exness MT4, traders can experience a blend of smooth user experience and robust functionality. This collaboration ensures that users not only get access to the MT4 platform, but also unmatched support and resources from Exness.

Why choose Exness MT4 platform?

When it comes to trading platforms, Exness MT4 emerges as the prime choice for both beginners and experts. Here’s why:

- Wide spectrum of instruments: Exness MT4 includes over 120 currency pairs, CFDs on metals, energies, indices, stocks, cryptocurrencies and more.

- Dynamic Execution Type: Depending on your trading strategy, choose between instant execution and market execution.

- Advanced Order Options: With 6 types of pending orders, you have flexibility in trading operations.

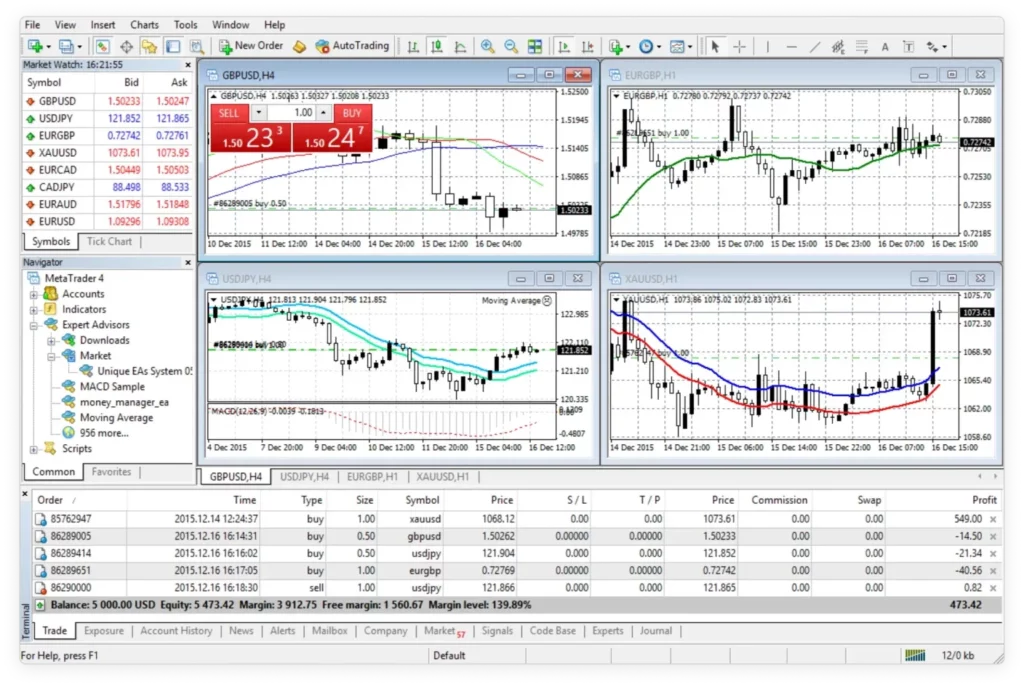

- Extensive charting tools: Equip yourself with a variety of chart types, technical indicators and analytical objects for nuanced market analysis.

- Automated Trading: Use Expert Advisors (EAs) to automate your trades, ensuring consistent strategy execution.

- Highest Security: With 128-bit encryption and SSL protocol, rest assured that your data will remain safe on Exness.

- Multi-Device Accessibility: Whether you are on PC, Mac or mobile, Exness is available for your convenience. Plus, experience seamless trading with the Exness MT4 WebTerminal and MultiTerminal options.

For a more detailed comparison, see the table below:

| Speciality | Description |

| 📄 Equipment | CFDs on over 120 currency pairs, metals, energies, inventories, stocks, cryptocurrencies and more. |

| 🔄 Execution type | Instant Execution and Market Execution |

| ⏳ Waiting order | Buy Stop, Sell Stop, Buy Limit, Sell Limit, Take Profit, Stop Loss |

| ⚖️ Leverage | 1:Unlimited for currency pairs and 1:2000 for other instruments |

| ↔️ Spread | Starts at 0.3 pips and goes up to 0 pips on some accounts |

| 💲Commission | Starts from $3.5 per lot on some accounts |

| 💰 Minimum deposit | From $1 for standard cent accounts to $200 for others |

| 📐 Lot size | From 0.01 (micro lots) to unlimited, depending on account type |

| 🛑 Margin Call/Stop Out | Varies by account type, for example, 60%/0% on Standard Cent |

| 🌍 Trading platform | MT4 for Desktop, Web, Mobile, and MultiTerminal |

| 📊 Charting tools | Diverse options, such as 3 chart types and 30 built-in technical indices |

| 🤖 Automated trading | Supported through Expert Advisors (EAS) and MQL4 |

| 🔒 Security | Ensured with 128-bit encryption and SSL protocol |

By providing a rich set of assets and reliability, Exness emerges as the leading choice for traders worldwide.

System Requirements for Exness MetaTrader 4 (MT4)

To ensure smooth trading with Exness MetaTrader 4, it’s important to meet the platform’s system requirements across different devices. Below is a detailed comparison of the minimum and recommended specifications for running MT4 on Windows, Mac, Android, and iOS. To get started, you can download Exness MT4 from the official Exness website and install it on your device to begin trading.

| Platform | Operating System | Processor | RAM | Disk Space | Internet | Additional Requirements |

|---|---|---|---|---|---|---|

| MT4 for Windows | Windows 7/8/10/11 | 1 GHz or higher | 512 MB minimum (1 GB recommended) | 50 MB free space | Stable internet connection | DirectX 9.0c or higher, VGA or higher resolution |

| MT4 for Mac | macOS 10.9 (Mavericks) or higher | Intel Core i5 or higher | 2 GB or more | 50 MB free space | Stable internet connection | OS X virtualization software for full compatibility |

| MT4 for Android | Android 4.0 or higher | ARM or x86 compatible processor | 1 GB or more | 30 MB free space | Active internet connection | Touchscreen interface supported |

| MT4 for iOS | iOS 10.0 or higher | iPhone 5s or higher | 1 GB or more | 30 MB free space | Stable internet connection | iOS version 10.0 or higher required for full functionality |

Installation Guide for Exness MT4

Enhance your trading experience by downloading and installing Exness MT4, a free and powerful platform available for both PC and Mac. Follow the steps below for a smooth setup.

How to download for PC

- Go to the Exness website: Access the official Exness website from your PC.

- Hover over ‘Platform’: Located at the top of the main page.

- Select ‘MetaTrader 4’: From the dropdown menu, click on the ‘MetaTrader 4’ option.

- Click ‘Download MetaTrader 4’: This will start the download of the exness4setup.exe file for Windows.

- Run the installer: Once the download is complete, locate the file in your Downloads folder and double-click it to begin the installation. Follow the on-screen instructions to complete the installation.

Installation steps for Mac

- Go to the Exness website: Access the official Exness website from your Mac.

- Hover over ‘Platform’: Located at the top of the main page.

- Select ‘MetaTrader 4’: From the dropdown menu, click on the ‘MetaTrader 4’ option.

- Click ‘Download MetaTrader 4’: This will start the download of the exness-mt4.dmg file for Mac.

- Locate the downloaded file: Find the exness-mt4.dmg file in your downloads.

- Double-click the .dmg file: This will open a new window.

- Drag and Drop: Move the MT4 application icon to your Applications folder.

- Open MetaTrader 4: Go to your Applications folder, find MT4 and launch it. You can now log in with your Exness credentials and start trading.

Mobile Download: Android and iOS

- Navigate to ‘MetaTrader Mobile Apps’ on Exness: From the main page, hover over ‘Platform’ and select ‘MetaTrader Mobile Apps’.

- Choose your version: Depending on your preference and device, select ‘Download MetaTrader 5 Mobile’ for either iOS or Android, or choose the Android .apk version.

- Scan QR Code (Optional): You can scan the QR code for your respective device to directly access the download page.

- Install the app: Follow the prompts to install the Exness app on your device.

- Launch and Trade: Launch the app, log in using your Exness account details and start trading.

Using Web Terminal

- Visit the Exness website: Access the Exness website in your browser.

- Hover over ‘Platform’: Located at the top of the page.

- Select ‘MetaTrader WebTerminal’: From the dropdown, select ‘Exness MetaTrader WebTerminal‘.

- Click ‘Launch MetaTrader Web’: This will take you to the web version of the MetaTrader platform.

- Log in and trade: Use your Exness account details to log in and start trading.

Registration and Login Process

To trade on Exness, it is important to set up an account and sign in to the platform. We’ll guide you through this straightforward process in the section below. If you’re unsure how to download MT4 in India, follow the simple steps outlined here to get started with one of the most reliable trading platforms available.

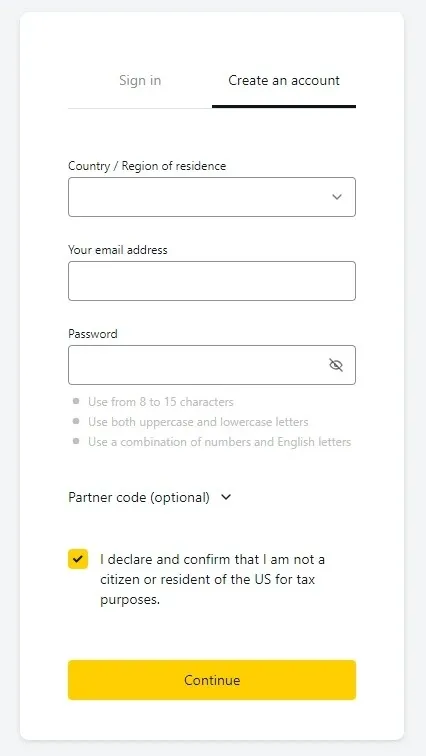

How to Register on Exness MT4

Follow these steps to create an account:

- Visit the official website of Exness and select the ‘Sign Up’ option located in the upper right corner.

- Provide your country/region, email address and a secure password. It is important that you acknowledge and verify that you are not a US citizen or resident for tax reasons. Once filled, click ‘Continue’.

- A verification code will be sent to your provided email. Enter this code at the time indicated on the site and hit ‘Verify Exness‘.

- Well done! Your registration on Exness is complete. This gives you access to your personal area, from which you can view your accounts, Exness deposits and withdrawals, etc.

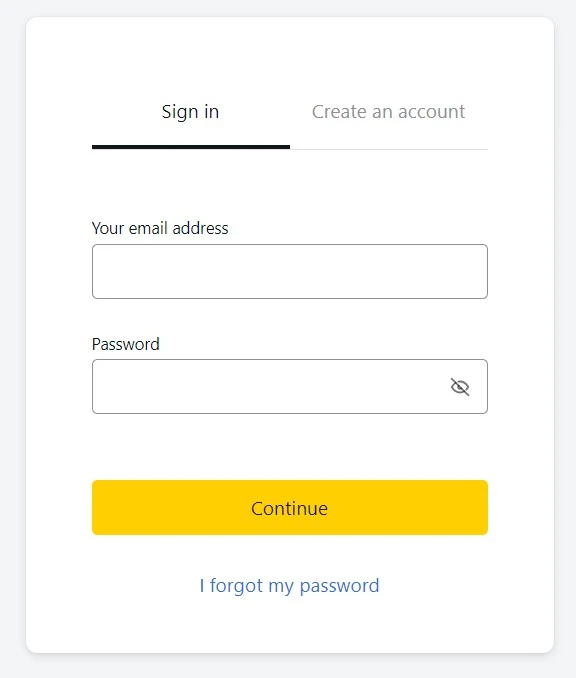

Steps to login to your Exness MT4 account

To use Exness to trade effectively, it is important that you know how to link your Exness account with the MT4 platform. Here’s how you can do it easily:

- Launch the MetaTrader 4 platform: After downloading and installing the platform, open it on your preferred device.

- Find the Exness Server: In the platform, go to ‘File’ and then select ‘Login to Trade Account’. In the pop-up window, type “Exness” in the Server field. A list of Exness servers should appear.

- Enter your credentials: Provide your Exness login ID and the password you set during the registration process on the Exness website.

- Choose the right server: If you are using a demo account, make sure you select the Exness-demo server. For real accounts, choose Exness-Real Server.

- Connect and verify: Click the ‘Login’ button. Once connected, in the lower right corner, you should see your connection status. If it shows ‘No connection’, double check your login details. If it indicates ‘Connected’, you are good to go.

- Start Trading: Now your Exness account is linked to MT4, you can start trading. Your account details including balance, equity and margin will be displayed in the ‘Trade’ tab.

Remember, connecting Exness with MetaTrader 4 allows you to enjoy the robust features of the MetaTrader platform while trading along with the benefits offered by Exness. Always ensure that you are connected to the correct server and that your login details are correct to maintain a seamless trading experience.

Recovering your password and troubleshooting login issues

Forgetting passwords or experiencing login issues can be frustrating, especially when you want to access your Exness account immediately. However, these challenges can be resolved quickly. This way:

Forgot password:

- Initiate recovery: Go to the Exness login page and click “Forgot Password?” Click on. Add.

- Provide email: Enter the email address associated with your Exness account. Click ‘Next’ or ‘Submit’.

- Verify your identity: You will receive a password reset email containing a verification code or a direct link to set a new password.

- Reset and Confirm: If asked for a code, enter it on the website. Then, set a new secure password, making sure it meets the platform’s security criteria.

Common login issues:

- Server Selection: Make sure you have chosen the correct server type (Demo or Real) in MetaTrader 4.

- Connection Status: In MT4, the lower right corner shows your connection status. If it displays ‘No connection’, it could be a server issue or incorrect login details.

- Caps Lock: Sometimes, a login issue can be as simple as turning on the Caps Lock key. Make sure it is off when entering your password.

- Account Verification: If your account is not verified, it may prevent you from logging in. Ensure that all required documents have been submitted and approved by Exness.

Other troubleshooting tips:

- Update Platform: Make sure you have the latest version of the MetaTrader 4 platform. Outdated software can sometimes cause login problems.

- Contact Support: If you have tried the above steps and still cannot access your account, it is time to contact Exness Customer Support. They can provide real-time support and resolve any underlying issues you may be unaware of.

- Reinstall MT4: If the problem persists, consider reinstalling the platform. Sometimes, minor errors can be fixed with a fresh installation.

Safety should be your priority in any situation. When resetting your password, choose a strong and unique combination to protect your account from unauthorized access. Always make sure you are logging in from a secure device and network. If in doubt, it is best to contact Exness Support for tailored assistance.

Practice with Exness MT4 Demo Account

If you are just stepping into the world of Exness or want to refine your trading strategies without any financial risk, the Exness MT4 demo account is an ideal choice. This simulated account provides an authentic trading environment, letting you work with imaginary funds under live account-like conditions. It provides full access to the myriad features of Exness MetaTrader 4, from various trading tools, leverage settings to Expert Advisors and indicators. This setup empowers you to evaluate your trading ability and understand areas for improvement. To get started, simply download Exness MT4 and begin exploring the platform risk-free.

Here’s a brief guide to getting started with an Exness MT4 demo account:

- Access your personal area on Exness, go to ‘My Account’, and then select the option ‘Open New Account’.

- Decide on the Exness account type you would prefer (for example, Standard or a Business) and proceed with ‘Try the Demo’.

- When entering account details, make sure you select the MT4 trading platform. Set an account password and then click ‘Create Account’.

- An email containing your account credentials and server specifications will be sent to you. This data can also be retrieved from the ‘My Account’ section in your Personal Area.

- At this stage, you are free to download the Exness MT4 platform and start your demo trading journey using the provided account details.

The flexibility of the platform allows you to set up multiple demo accounts, facilitating experimentation with different configurations and strategies. It is very easy to transfer between demo and real accounts depending on your preferences. Nevertheless, it is paramount to understand that while the demo account provides valuable insight, it cannot replicate real market fluctuations and the emotional aspects that influence trading choices. While a demo account serves as a helpful learning platform, its results should not be the sole determinant of your trading skills. Remember, this is an important step, not a complete reflection of the real world trading arena.

Benefits of using Exness MetaTrader 4

MetaTrader 4, when combined with the power of Exness, delivers a distinctive trading experience that has captured the attention of traders globally. Here’s why:

- Expert Advisors (EAs): These automated trading algorithms, commonly known as robots or Forex assistants, work in real time, responding to market fluctuations or predetermined conditions. Exness MT4 offers the added benefit of allowing traders to create their own EAs and potentially market them on the MetaTrader market.

- Extensive Indicator Suite: Beyond the standard 30 indicators integrated into MT4, the platform produces these algorithms in the MQL4 language, which has the primary function of clearly depicting possible price variations.

- Script functionality: Contrary to the common notion of scripts, on Exness MT4, they are designed to act upon the onset of a specific event. However, one should keep in mind that while one script is running, other Forex transactions remain paused. These scripts come in handy for risk assessment, transaction management and even order placement during off-market hours.

- Resourceful Libraries: A convenient repository in the platform, libraries are where traders can store and quickly access frequently used custom functions and segments.

- Advanced Security Protocols: Trading with Exness on MT4 assures traders that their accounts are strong. This is made possible by employing encryption for data transferred between the terminal and the platform server, and by the integration of RSA digital signatures.

With tools designed to help predict entry and exit points, as well as the ability to evaluate price movements across nine different time-frames, Exness MT4 allows traders to confidently navigate the financial markets. Strengthens with necessary resources.

Common Exness MT4 Issues for Indian Traders and Solutions

Slow Execution Speed

To resolve slow execution speed, ensure that your internet connection is stable and fast. Using a wired connection rather than Wi-Fi can also help improve stability. If needed, switching to MT5 may provide faster execution speeds.

Unable to Open or Close Trades

If you’re unable to open or close trades, check your internet connection for stability. Ensure your account has enough funds for the trade, and verify that there are no restrictions on the trading instruments you’re attempting to use.

Server Connection Problems

Server connection problems can often be fixed by restarting your router to refresh the connection. It’s also useful to check if Exness servers are down by visiting their website for updates. If the issue persists, wait a few minutes and try reconnecting.

Order Execution Delays

Order execution delays are common during periods of high market volatility. To prevent this, increase the slippage tolerance in your MT4 settings. Using limit orders instead of market orders will also give you more control over order execution.

Account Login Issues (Wrong Password/Error)

If you encounter login issues, double-check your username and password. If you continue facing problems, try resetting your password through the Exness client portal. Make sure your account is active and not restricted.

Currency Conversion Errors (INR to USD)

Currency conversion errors can occur when trading in INR. Make sure you’ve selected the correct account currency, and check if there are any broker restrictions related to INR. If the issue persists, contact Exness support for assistance.

Technical Indicator Issues (Not Showing/Updating)

When technical indicators are not showing or updating correctly, try refreshing the chart or restarting the platform. Also, check that you are using the correct settings for your indicators. Keep your MT4 platform updated to the latest version to avoid such issues.

Installation Problems (MT4 Setup)

If you encounter installation problems, make sure you are using the correct version for Windows or Mac. For Exness MT4 for Windows, ensure that your system meets the necessary requirements. Temporarily disable any antivirus software during installation as it might block the process. If installation continues to fail, download the latest version of MT4 directly from Exness’ official website.

Mobile App Login Issues (MT4 for Android/iOS)

If you’re having trouble logging into the mobile version of MT4, ensure your username and password are correct. Check that your internet connection is stable. If necessary, reinstall the MT4 app and update it from the Google Play Store or App Store.

Data Feed Lag (Delayed Prices)

Data feed lag can often be fixed by ensuring a stable and fast internet connection. If you continue to experience issues, consider using Exness’ VPS service to improve your connectivity and provide faster data feeds. For persistent problems, contact Exness support for further assistance.

How to Download Your Trading History from Exness MT4

To download your trading history from Exness MT4, open the platform and go to the “Terminal” window at the bottom (press Ctrl+T if you don’t see it). Click the “Account History” tab, right-click, and select “Save as Report” to create an HTML file of your trades.

Alternatively, you can get your trading history from the Exness website. Log in to your Personal Area at exness.com, find the “My Accounts” section, and pick the account you want. Then, go to “Account History” or “Statements,” choose your date range, and download the report in a format like PDF or CSV. This option is great if you need more flexibility or want to keep detailed records.

Comparison of MT4 and MT5 for Exness

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two of the most popular trading platforms used by traders globally. Both platforms are offered by Exness, but each has its own set of features, advantages, and limitations. Below is a comparison of the key differences between MT4 and MT5 to help you choose the best platform for your trading needs.

| Feature | MT4 | MT5 |

|---|---|---|

| Platform Type | Forex and CFDs trading | Forex, CFDs, Stocks, Futures, and Options trading |

| Number of Order Types | 4 | 6 |

| Number of Timeframes | 9 | 21 |

| Charting and Analysis Tools | 30+ indicators, 2 analytical objects | 38 indicators, 44 analytical objects |

| Market Depth | Not available | Available (Order book view for market depth) |

| Languages Supported | 30+ languages | 38 languages |

| Execution Speed | Fast execution (depends on internet) | Faster execution, more flexible routing |

| Multi-Asset Support | Forex, CFDs | Forex, CFDs, Stocks, Futures, and more |

| Programming Language | MQL4 (MetaQuotes Language 4) | MQL5 (MetaQuotes Language 5) |

| Number of Symbols | 128 symbols max (depending on broker) | Unlimited symbols, better multi-asset support |

| Timeframe Customization | Fixed timeframes only | Custom timeframes available |