Trading with leverage can make big profits or big losses. Many traders lose money because they don’t understand how Exness leverage works. Learning about leverage is the key to successful trading.

Exness gives traders many leverage options. You can start small or use high leverage. The trick is knowing which one to use and when.

What Is Leverage and How Does It Impact Your Trades?

Leverage lets you trade with more money than you have. It’s like borrowing money from your broker. With 1:100 leverage, your $1 controls $100 in trades.

What is leverage in Exness? It makes your trading power bigger. If you have $1000 and use 1:500 leverage, you can trade $500,000 worth of currency. This sounds great, but losses also get bigger.

Many new traders make this mistake. When the market moves against them by just 2%, they can lose 40% of their money. This shows that leverage exness offers needs careful handling.

Here’s what happens with high leverage:

- You need less money to open trades

- You can make bigger trades

- Profits can be much larger

- Losses can destroy your account

Your stop loss becomes very important with high leverage. A small 50-pip move on EUR/USD with 1:2000 leverage can wipe out your account. But if you use it right, you can make good money with small amounts.

Unlimited Leverage Options

Exness unlimited leverage is real and available to some traders. You can get unlimited leverage on major currency pairs after meeting certain rules.

The broker doesn’t give unlimited leverage to everyone. You need to prove yourself first:

- Make at least 10 trades

- Trade for 30 days

- Risk no more than 5% of your account per trade

Exness leverage 1:2000 is available right away for most traders. This works well for experienced traders who know how to manage risk. It’s good for quick trades with tight stop losses.

Here’s what leverage you can get on different markets:

| What You Trade | Highest Leverage | Unlimited Available |

| Major Currency Pairs | 1:2000 | Yes |

| Minor Currency Pairs | 1:2000 | Yes |

| Exotic Pairs | 1:400 | No |

| Gold | 1:2000 | Yes |

| Silver | 1:200 | No |

| Oil | 1:200 | No |

| Stock Indices | 1:200 | No |

| Crypto | 1:100 | No |

Exness maximum leverage depends on your account type too. Professional accounts get higher leverage than basic ones. It’s smart to start with lower leverage until you know what you’re doing.

Understanding Leverage Ratios

Let’s make these numbers simple. When you see 1:500 leverage, it means you control $500 for every $1 you put up.

Leverage in Exness works like this:

- 1:100 = Your $1 controls $100

- 1:500 = Your $1 controls $500

- 1:2000 = Your $1 controls $2000

The bigger the second number, the more trading power you have. But more power means you can lose money faster too.

Here’s a simple rule for different markets. When the market is trending clearly, use 1:100 or 1:200. When the market moves in small ranges, you might use 1:500. Only use 1:2000 for very quick trades with small stop losses.

Think about this example. A standard trade on EUR/USD needs $500 with 1:200 leverage. The same trade only needs $50 with 1:2000 leverage. You have $450 extra sitting there, making you want to trade more.

Don’t do it. Just because you can doesn’t mean you should.

How to Change Leverage on Exness

Changing your leverage on Exness is easy and takes less than a minute. Many traders change their leverage based on what they’re trading and market conditions.

How to change leverage Exness:

- Go to your trader’s area

- Find your trading account

- Click the settings button

- Click “Change Leverage”

- Pick your new leverage

- Click confirm

How to use leverage in Exness starts with picking the right number for your strategy. Change your leverage based on:

- How much the market is moving (use less when it’s jumpy)

- How long you hold trades (more for quick trades)

- How much money you have (less for small accounts)

- How much experience you have (beginners need less)

You can change leverage anytime, but it only affects new trades. Old trades keep their original leverage until you close them.

Smart tip: Use different leverage for different strategies. Keep 1:100 for long-term trades and 1:1000 for quick scalping. This stops you from using too much leverage on the wrong trades.

Exness Leverage Rules and Limitations

Exness leverage rules protect both the broker and traders from big losses. These rules have saved many traders from losing everything.

Important rules include:

Money-based limits: Your leverage goes down as your account gets bigger. If you have more than $20,000, your max leverage drops to 1:200. This makes sense because big accounts don’t need extreme leverage.

Weekend limits: Leverage gets reduced before weekends on some trades. On Friday afternoon, your 1:2000 might become 1:200. Always check your trades before the weekend.

News limits: During big economic news, leverage can drop for a short time. This happens around job reports and central bank meetings.

Different rules for different markets: Each market has its own rules. Crypto maxes out at 1:100, while major currency pairs can go unlimited.

The unlimited leverage rules are:

- At least 10 completed trades

- 30 days of trading history

- Max 5% risk per trade

- Only works on major markets

These rules actually help traders by making them manage risk properly.

Exness Leverage for Beginners

Exness leverage for beginners should be small at first. New traders should forget about 1:2000 leverage until they can make money consistently with 1:50 or 1:100.

Best leverage for Exness beginners is 1:100 at most. Here’s why:

Learning to trade is hard enough without making losses bigger. Focus on learning these skills first:

- Reading charts

- Knowing when to enter and exit trades

- Managing risk

- Controlling emotions

Once you master these with low leverage, you can slowly increase your leverage.

Good plan for beginners:

- First 3 months: Use 1:50 leverage max

- Months 4-6: Try 1:100 if you’re making money

- After 6 months: Think about higher leverage carefully

Exness leverage for beginners works best with:

- Small trade sizes (0.01-0.10 lots)

- Close stop losses (20-50 pips max)

- Small profit targets

- Never risk more than 2% per trade

Remember, leverage doesn’t make profits. Good trading strategies do. High leverage just makes whatever you’re doing bigger – good or bad.

Exness Leverage in India

Exness leverage in India works the same as everywhere else, but Indian traders have some special things to think about. Many Indian traders use high leverage successfully.

India’s trading rules create some unclear areas. Exness leverage in india is available, but local rules prefer lower leverage. Many successful Indian traders stick to 1:100 or 1:200 to avoid problems with regulators.

Currency trading matters too. Trading Indian Rupee pairs with high leverage can be hard because they don’t move much. Most Indian traders focus on major pairs like EUR/USD or GBP/USD where Exness leverage in India works better.

Popular strategies for Indian traders:

- Carry trading with medium leverage (1:100-1:200)

- Range trading during busy market hours

- News trading with quick entries and exits

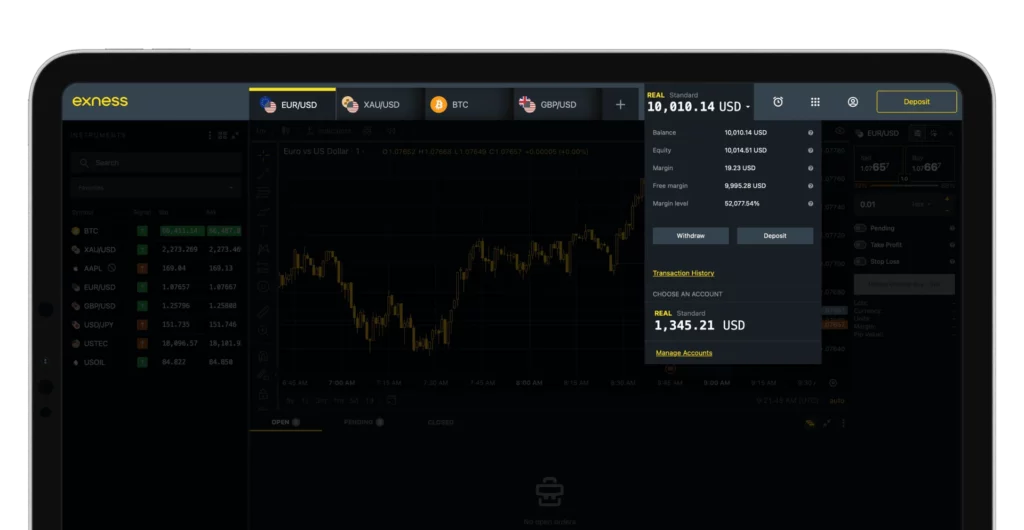

Understanding Margin Requirements

Exness margin requirements tell you how much money you need to open trades. Calculate this before every trade to avoid surprises.

The math is simple: Margin Needed = (Trade Size × Price) ÷ Leverage

For a standard EUR/USD trade at 1.1000 with 1:500 leverage: Margin = (100,000 × 1.1000) ÷ 500 = $220

Exness margin level shows how healthy your account is: Margin Level = (Your Money ÷ Used Margin) × 100

Keep your margin level above 300%. This gives you room when trades go against you without getting margin calls.

Different account types need different margins:

| Account Type | How Margin Works | Special Things |

| Standard | Fixed spread + fee | Easy to calculate |

| Raw Spread | Low spread + fee | Changes with market |

| Zero | No spread + fee | Higher margin rates |

| Professional | Reduced margin | Higher leverage allowed |

Exness Margin Call and Stop Out Levels

Exness margin call happens when your margin level drops to 60%. This is your warning to close losing trades or add money fast.

The stop out level is at 20%. When your margin level hits this, Exness automatically closes your worst trades. Never let this happen with good risk management.

Here’s how it works:

You have $1000. You open trades that need $800 margin. Your account drops to $480 because of losses. Your margin level is now 60% ($480 ÷ $800 × 100). You get a margin call warning.

If losses continue and your money drops to $160, you hit 20% stop out. Exness starts closing your trades automatically.

Use these levels to manage risk:

- 100% margin level = Make smaller trades

- 80% margin level = Think about closing losing trades

- 60% margin level = Emergency – act now

The key is never getting close to these levels. Good position sizing and stop losses prevent margin calls completely.

Frequently Asked Questions (FAQs)

What is the maximum leverage available on Exness?

Exness offers unlimited leverage on major currency pairs and gold for qualified traders. For most markets, the maximum is 1:2000. To get unlimited leverage, you need 10 trades and 30 days of trading experience.