Exness platform is recognized for its clear and straightforward fee structure, offering competitive pricing. Understanding the fees involved in trading on the platform is essential for traders to effectively manage their costs. This guide will explain the different fees you might come across while trading with Exness, including spreads, commissions, overnight swap fees, deposit and withdrawal fees, inactivity fees, and more. The following sections provide a detailed breakdown of each fee type.

Main Categories of Exness Fees

Exness applies various fees based on the asset, account type, and trading conditions. Below, we’ll explain the different fee categories that impact traders.

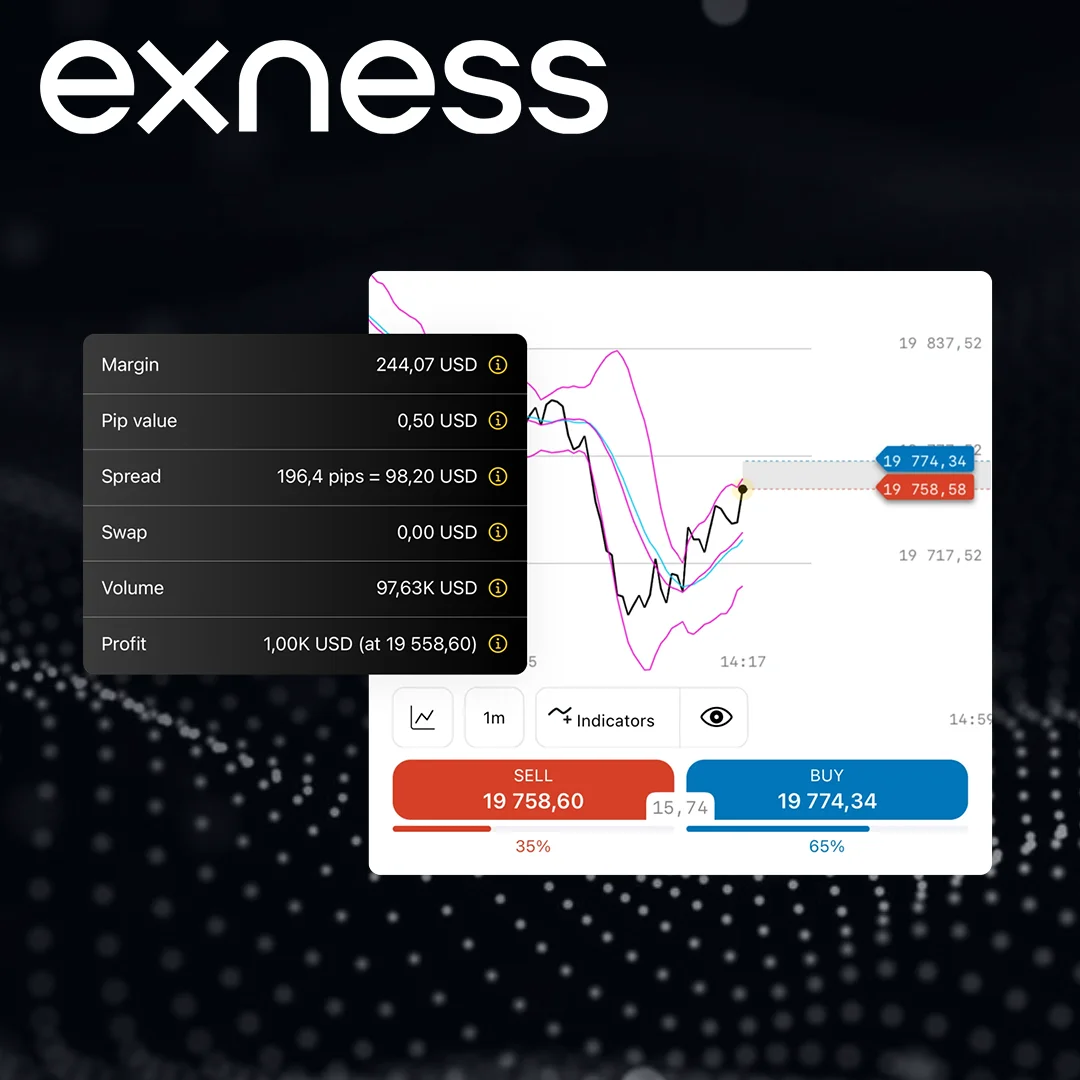

Commissions and Spreads on Exness

The spread is one of the most significant costs traders face. Platform offers both fixed and variable spreads depending on the Exness account type. Some accounts also include commissions, particularly for high-frequency traders.

| Spread Type | Standard Account | Pro Account | Zero Account | Raw Spread Account |

|---|---|---|---|---|

| EUR/USD Spread (Standard) | 1.0 pips | From 0.1 pips | 0.0 pips | From 0.0 pips |

| Commission | None | None | $3.50 per lot | $3.50 per lot |

| Additional Notes | Best suited for beginners and casual traders | Great for active traders seeking balance | Suitable for high-frequency traders | Ideal for scalpers or traders who need tight spreads |

- Standard Account: Offers a fixed spread, making it easy for beginners to manage their costs. No commission is charged, so it’s best for those who trade less often.

- Pro Account: With variable spreads, this account provides more flexibility, making it ideal for traders looking for a balance between cost and market conditions.

- Raw Spread Account: Offers raw spreads with a commission per trade. This account is perfect for scalpers and traders who focus on very tight spreads

- Zero Account: Features low fixed spreads but includes a commission per trade, making it suitable for those who trade frequently.

Overnight Fees (Swap Fees)

| Asset Class | Swap Long Fee | Swap Short Fee | Overnight Fee | Additional Notes | Factors Influencing Fees |

|---|---|---|---|---|---|

| Cryptocurrencies | Varies | Varies | Varies | Swap fees tend to be higher due to increased volatility. | Market volatility, liquidity |

| Stocks | Varies | Varies | Varies | Charges fluctuate based on the market performance. | Market trends, company performance |

| Commodities | Varies | Varies | Varies | Can be positive or negative depending on interest rates. | Global economic factors, commodity prices |

| Forex | Varies | Varies | Varies | Affected by market conditions and the currency pair. | Interest rate differentials, market volatility |

- Forex Swap Fees: These depend on the specific Exness currency pair and current market conditions, with fees that may be either positive or negative based on interest rate differences.

- Commodities and Stocks: The swap fees for commodities and stocks can change depending on factors such as the global economic environment and the asset’s performance in the market.

- Cryptocurrency Swap Fees: Due to higher volatility, cryptocurrencies often incur higher swap fees compared to other asset types.

Exness Withdrawal and Deposit Fees

Exness offers a wide range of deposit and withdrawal options. While most methods are free, third-party services may apply small fees.

Deposit Fees

Exness allows you to deposit funds through various options such as bank transfers, credit/debit cards, e-wallets, and cryptocurrencies.

| Fee | Processing Time | Minimum Deposit | Notes | Deposit Method |

|---|---|---|---|---|

| Free | 1-3 business days | $10 | Processing time depends on the bank. | Bank Transfer |

| Free | Instant | $10 | Deposits are processed instantly. | Credit/Debit Card |

| Free | Instant | $10 | Fast deposits with no fees from Exness. | E-Wallets (Skrill, Neteller, etc.) |

| Free | Instant | $10 | No third-party fees involved. | Cryptocurrencies |

- Bank Transfers: While Exness doesn’t charge fees, third-party banks may apply charges. Processing usually takes 1-3 business days.

- Cryptocurrencies: Deposits are processed instantly, and no third-party fees are involved, with withdrawals happening immediately as well.

- Credit/Debit Cards: Deposits are instant with no fees from Exness, but withdrawal can take up to 3 business days.

- E-Wallets: Deposits via Skrill, Neteller, or similar services are instant and free from Exness. Withdrawal is also fast and free of charge from Exness.

Withdrawal Fees

Exness offers several options for withdrawing funds, including bank transfers, e-wallets, and cryptocurrencies. Most withdrawals are free, though third-party fees may apply.

| Fee | Processing Time | Minimum Withdrawal | Notes | Withdrawal Method |

|---|---|---|---|---|

| Free | 1-3 business days | $10 | Some banks may charge additional fees. | Bank Transfer |

| Free | 1-3 business days | $10 | Withdrawals may take up to 3 business days. | Credit/Debit Cards |

| Free | Instant | $10 | Fast withdrawals with no fees from Exness. | E-Wallets (Skrill, Neteller, etc.) |

| Free | Instant | $10 | Withdrawals are instant with no additional charges. | Cryptocurrencies |

- Bank Transfers: Exness doesn’t charge any fees for withdrawals, but certain banks may apply their own charges during the process. Withdrawals usually take 1-3 business days.

- Cryptocurrencies: Withdrawals using digital currencies like Bitcoin or Ethereum are processed instantly and are free from additional charges by Exness.

- Credit/Debit Cards: Exness doesn’t charge a withdrawal fee, but the withdrawal process may take up to 3 business days to complete.

- E-Wallets: Withdrawals via services like Skrill or Neteller are processed instantly and are free from Exness fees, though third-party fees may apply.

Additional Fees

Exness may charge extra fees in some cases, such as inactivity fees and currency conversion fees, in addition to the regular trading charges.

| Fee Type | Amount | Conditions | Processing Time | Payment Method |

|---|---|---|---|---|

| Inactivity Fee | $0 – $10 per month | Charged if there’s no trading activity for more than 6 months. | N/A | N/A |

| Manual Account Fee | $10 – $50 per request | Applied when manual intervention is required (e.g., processing withdrawals). | Varies (based on request) | Bank Transfer, E-Wallets, etc. |

| Currency Conversion Fee | 0.5% – 2.0% | Charged when depositing or withdrawing in a currency different from your account’s base currency. | Instant | Bank Transfer, Credit/Debit Cards, E-Wallets, Cryptocurrencies |

- Inactivity Fee: This fee is applied if there’s no trading activity for more than 6 months. It’s typically low, and can be avoided by maintaining an active account.

- Manual Account Fee: Exness charges this fee when manual processing is required, such as when withdrawing funds or making special requests.

- Currency Conversion Fee: This fee applies when you deposit or withdraw funds in a currency that is different from your account’s base currency.

Exness Fee Comparison with Leading Brokers

To better understand how Exness’s fees compare with other brokers, here’s a breakdown of key fee categories:

| Fee Type | Exness | eToro | IG Markets | Plus500 |

|---|---|---|---|---|

| Account Types | Standard, Pro, Zero, Raw Spread | Standard, Pro | Standard, Pro | Standard |

| Minimum Deposit | $10 | $200 | $300 | $100 |

| Spread (EUR/USD) | 0.0 pips (Raw Spread) | 1.0 pips | 0.7 pips | 0.6 pips |

| Commission | $3.50 per lot (Zero/Raw) | None | $2 per lot | None |

| Withdrawal Fees | Free (depends on method) | Free (with some restrictions) | $15 per withdrawal | $50 per withdrawal |

| Currency Conversion Fees | 0.5% – 2.0% | 0.5% – 2.0% | 1.0% – 3.0% | 1.0% – 2.5% |

- Exness: Provides competitive spreads, with no withdrawal fees and minimal currency conversion charges.

- eToro: Requires a higher minimum deposit and has a spread of 1.0 pips. Conversion fees are applied.

- IG Markets: Offers tighter spreads but comes with a higher minimum deposit and withdrawal fees.

- Plus500: Has higher withdrawal fees compared to Exness.

Conclusion

Exness provides a clear and competitive fee structure suitable for traders at all levels. With a variety of account types, no deposit fees, and different withdrawal methods, Exness stands out for its trader-friendly approach. Understanding these fee categories, as explained in the tables above, will help you better manage your costs and make informed trading decisions.

Trade with trusted broker Exness today

See for yourself why Exness is the preferred broker of over 800,000 traders and 64,000 partners.

Frequently Asked Questions (FAQs)

What is the minimum deposit at Exness?

The minimum deposit varies by account type, with some accounts requiring as little as $10.