- seamless deposits

- 24/7 access

- hassle-free release of funds

This renowned Forex broker is regulated by seven trusted authorities, such as the UK’s FCA and Cyprus’s CySEC, while it is a market leader with a range of different trading products. There are cryptocurrencies, forex pairs, stocks, energies, metals, and others.

In addition to favorable trading conditions and a wide range of different tradable products, Exness offers convenient deposits and withdrawals via methods like bank wire transfers, debit/credit cards, Neteller, and Skrill. For traders looking to explore these opportunities, Exness trading provides a platform to manage funds efficiently. However, it is necessary for the beginning trader to understand these processes in order to be well organized and fully grasp the deposit and withdrawal procedures available for online trading.

This online trading guide will provide you with key information on the deposit and withdrawal measures available when transacting with Exness. We’ll walk through what typical time frames are expected from the merchant when making deposits and withdrawals, as well as examine tips for speeding up your withdrawals.

Available financing methods and base currencies

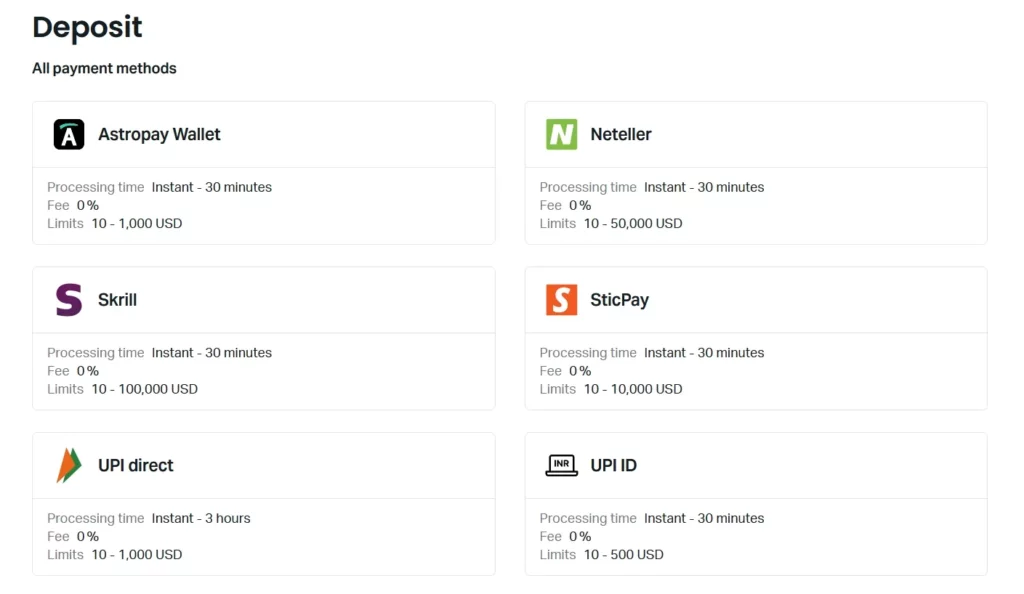

Exness offers you a choice of different payment options, each with its own minimum deposit limit and processing time. For those interested in Exness minimum deposit specifics, here is a list of financing methods available for Exness traders:

- Bank wire transfer

- Skrill

- Credit/Debit cards

- Neteller

Keep in mind that different countries may support different payment methods, so check the options available in your region before making a deposit. You can find the full list of all payment methods available in your Personal Area. You’ll also see why any methods may be blocked in your region.

Exness base currencies

Exness displays different base currencies depending on the different trading accout types. For the Standard Account, you can use different currencies, such as:

ARS, AED, AZN, AUD, BND, BHD, CHF, CAD, CNY, EUR, EGP, GHS, GBP, HUF, HKD, INR, IDR, JPY, JOD, KRW, KES, KWD, KZT, MXN, MAD, MYR, NZD, NGN, OMR, PKR, PHP, SAR, QAR, RHB, SGD, UAH, USD, UGX, UZS, XOF, VND, ZAR.

Keep in mind that you cannot change the base currency after setting up a trading account. Thus, whichever currency you deposit using, there will be a conversion fee. Therefore, it is important that you select the right base currency to avoid unnecessary expenses. However, you can open multiple Exness trading accounts for different base currencies in the same personal area.

Exness Deposit Overview

When you deposit cash into your Exness trading account, you have several banking options, including the following:

- Credit/Debit card

Exness accepts major credit and debit cards from banks worldwide. To deposit using your card, simply enter your card details and the amount to deposit. This option is faster and simpler, but you may have to pay a transaction fee from your bank. - E-Wallets

Exness accepts digital wallets such as Skrill and Neteller. You can easily link these wallets to your Exness trading account, and deposits are instant. - Bank wire transfers

Exness allows online traders to fund their accounts from their bank accounts via wire transfers. To fund your trading account using this method, you will need to obtain Exness account details and access your bank’s online portal or visit their branch. Funds will usually appear in your trading account within 72 hours, and there are no fees.

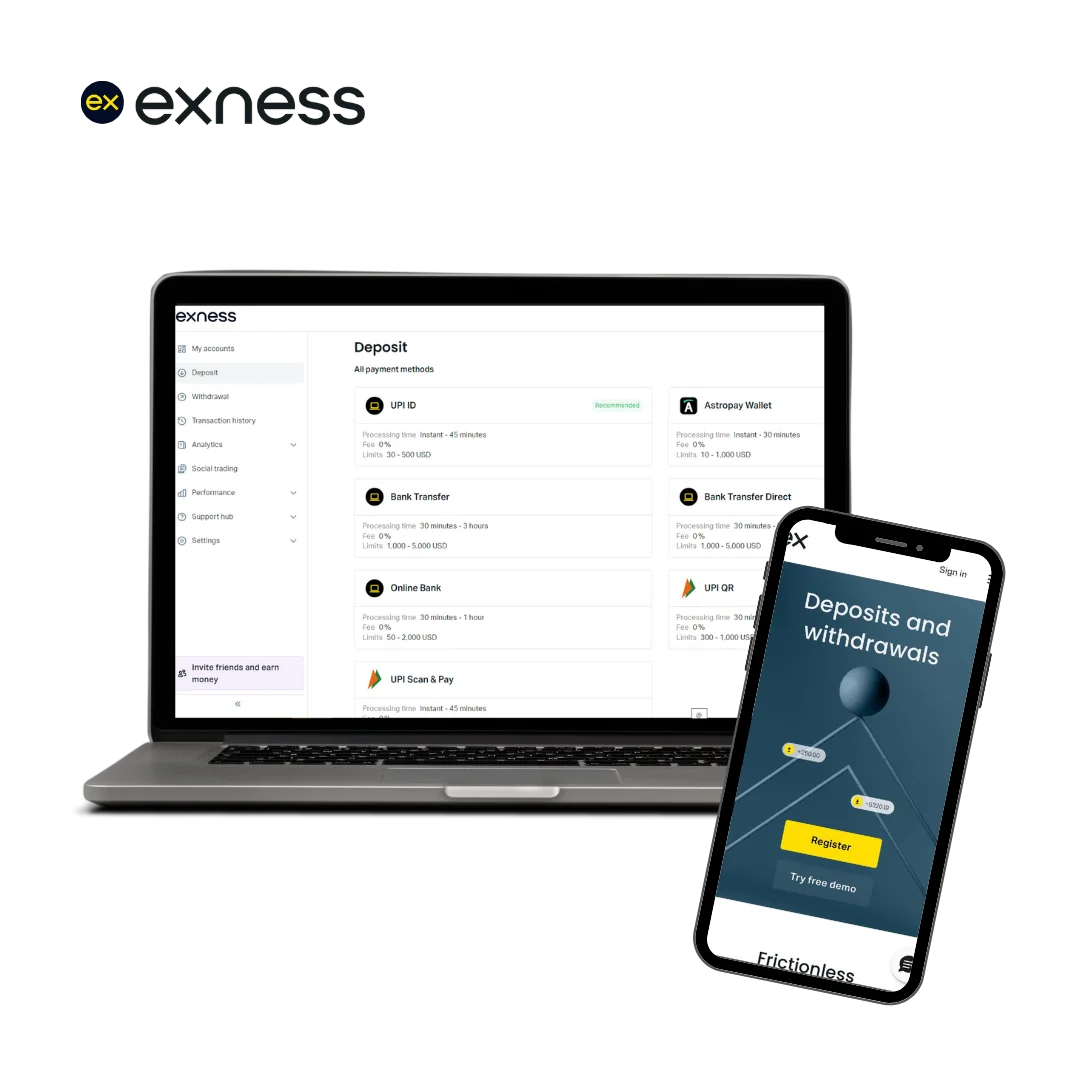

How to Deposit in Exness

While Exness provides you with an extensive list of different deposit methods to fund your account, use the following simple steps to make the process easy and intuitive:

- Go to the official site or application of Exness and log in to the personal area of your account. New traders on Exness should first create their account.

- When you have logged in to your personal area, click on the “Deposit” option on the side menu.

- Choose the payment method you prefer, such as credit cards, bank wire transfers, Neteller, or Skrill.

- Enter your account number on Exness, your selected base currency, and the amount to deposit. When you are finished, click “Next”.

- Cross-check your deposit details and confirm your payment.

- Your application or web browser will automatically redirect you to your payment provider, and you will follow the instructions on your screen to approve the payment request. When this is done, your payment provider will submit your payment, and the funds will be reflected in your account.

Exness Deposit limits and fees

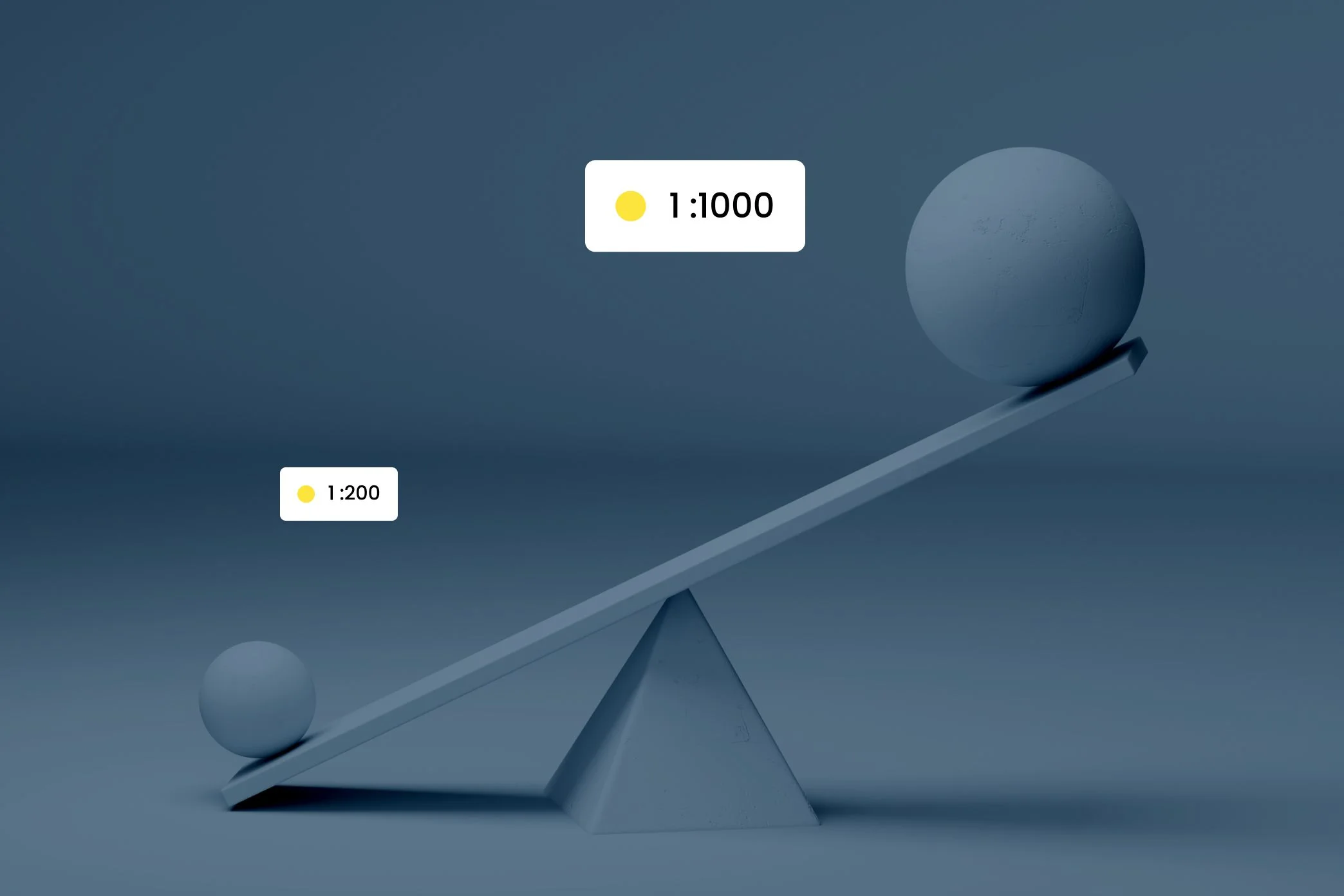

Deposits on Exness must meet specified limits, and you may incur certain fees depending on the payment method selected. However, different types of trading accounts have their specified limits, so it is important that you check the details from your account profile and support section. For example, a standard business account has a minimum deposit limit of $1, while a professional account has a limit of $200.

In addition to the account type, the payment methods you select will also determine the minimum deposit you can make:

- Credit/Debit Card – $3

- Skrill – $10

- Neteller – $10

- Bank Wire Transfer – Varies by bank

Exness generally does not charge any fees for depositing transactions into your trading account, but your selected payment provider may charge you some fees. The time applied for making deposits also depends on the payment system you select. However, most deposit systems transfer your funds instantly, within seconds after approval is complete.

Benefits of depositing funds in Exness

Exness believes that all deposits to your trading account should be easy, fast, and secure. In addition to offering different payment options, Exness also offers other benefits to traders, including:

- Exness traders can give everyone the opportunity to deposit their funds, even during public holidays and weekends.

- All deposits on Exness are generally free, although some banks, credit card providers, and third-party payment systems may charge additional transaction fees.

- Deposits are secure as Exness does not allow third parties to make payments on behalf of its users.

- Some deposit methods are instant, meaning you can deposit funds into your account and start trading within minutes.

- Standard online trading accounts at Exness have friendly minimum deposit requirements, although this amount may change with the payment method you select.

Exness Deposit Bonus

While Exness offers an impressive range of financial instruments, it does not offer any deposit bonuses and this does not match with their fundamental ideal values. Instead, Exness allows its clients to earn steady income through their partnership program. You can join the broker program and earn up to 40% of their income from every trader they introduce to Exness or earn up to $1850 per client through their affiliate program.

Exness Withdraw Guide

Allowing access to withdraw funds is an important factor for online trading. When trading with Exness, withdrawal options include:

- Bank Cards: Exness traders can initiate withdrawals via major credit and debit cards. Withdrawals are processed within one trading day, but there are withdrawal limits and bank fees.

- Bank Wire Transfer: You can request Exness to transfer your funds directly to a bank account by providing your bank details. These withdrawals take approximately 1-3 trading days, but there are generally no fees.

- E-Wallets: Linking e-wallets like Skrill and Neteller allows you to make withdrawals from Exness and receive your funds in minutes. However, in some cases, there is a possibility of third-party transaction fees.

How to withdraw funds from Exness

You can withdraw your money from Exness using various payment methods using these simple steps:

- Go to the official site of Exness and log in to the personal Exness area of your account.

- Select the “Withdraw” option located on the left menu of the page.

- Choose your preferred payment method.

- Enter your account details on Exness, your currency and the amount to withdraw, then click “Next”.

- Re-check your withdrawal details and enter the code you receive via SMS before confirming your payment.

- Provide the general details of your target payment account, such as account name and bank name, so that you can complete the transaction.

Exness withdraw time

Exness withdrawal times based on different payment methods:

| Withdrawal Method | Processing Time |

|---|---|

| Bank Transfer | 3-5 business days |

| Credit/Debit Cards | Up to 7 business days |

| Skrill | Instant to 24 hours |

| Neteller | Instant to 24 hours |

| Perfect Money | Instant to 24 hours |

| Cryptocurrencies | Up to 72 hours |

This information may vary depending on region and payment provider policies, so it’s advisable to check the latest details on the Exness website.

Exness withdraw limits and fees

To ensure fairness and transparency, Exness has several policies regarding withdrawal limits and fees. Here are some important points:

- Exness does not charge any withdrawal fees, but some third-party payment processors may have their own fees.

- The minimum withdrawal limit for most payment methods is $1, with direct bank transfers allowing a minimum withdrawal of $50.

- Exness reserves the right to refuse any withdrawal request that does not comply with the policies herein.

Exness withdrawal issues

Although Exness strives to streamline operations, in some cases, withdrawal requests may face delays or rejections. Here are some common issues that Exness traders may encounter.

Wrong withdraw details

Providing incorrect or incomplete information on your withdrawal request may cause delays and errors in processing. This is a common problem that Exness traders often face, especially when they are operating multiple accounts or using different banking methods. Therefore, it is important to double-check your payment details, such as name, account numbers, and banking method attributes, before submitting your withdrawal request.

Incomplete account verification

Trading accounts that have not been verified on Exness may have withdrawal limits due to the company’s strict KYC and anti-money fraud policies. These policies aim to guarantee the safety and security of their traders’ funds. Therefore, it is important that you complete the Exness verification process by uploading your address proof and valid identity documents, so that there are no delays or issues regarding your withdrawal.

Different payment methods

Generally, the banking method you select to deposit funds on Exness should be the same banking method used for the withdrawal process. Trying a different payment method may result in failure to withdraw funds. For example, if you deposit your money through a debit/credit card, you have to use the same account to withdraw your money. Traders who wish to change their payment method must update details in their account settings before placing a withdrawal request.

Technical issues

Although rare, technical issues can occur with your withdrawals on Exness. These technical issues may include server downtime, system maintenance, and other unexpected circumstances. If this happens, it is best to contact the Exness customer support team for assistance with your withdrawal request.

Trade with the Exness Mobile App

For smooth trading, Exness offers a secure mobile trading application that provides a desktop-like experience to meet the needs of all traders. Traders can access features and tools not available in the desktop version through their smartphones.

Some key features of the app:

- It provides online traders with access to various indicators so that they can evaluate trading charts and implement different strategies.

- The Exness application helps traders keep up with economic trends, evaluate price patterns, and access important market news.

- Management of trading accounts, including Exness demo account.

- Access to investment calculators to calculate the correct swaps, spreads, and margins.

In addition to these features, the Exness app allows you to make instant deposits, access over 130 financial instruments and withdraw your funds when you need them. Furthermore, the Exness application ensures reliable trading and provides smooth customer support, so you can keep your funds safe from any location.

Security measures for secure transactions

Investing in financial instruments comes with a risk element, but Exness has various safeguards in place to keep your trading experience safe. These security measures include:

Strong account security features

Exness takes a two-step approach to keeping your account secure. Their strong data encryption protocol stands as the first line of defense, ensuring that traders’ personal information is safe. This means that the data you share with Exness is protected with the highest level of security.

In addition to its strong encryption protocols, Exness takes extra steps to provide a two-factor authentication system for its traders. In addition to using your password to enter your personal area, the Exness app sends a unique code to your mobile phone to verify your identity in order to access your account whenever you want. Learn more about the legality of trading with Exness in India, ensuring compliance with local regulations and laws.

Split customer accounts

To protect traders’ funds, Exness has introduced the feature of segregated client accounts so that your funds can be kept separate from the company’s funds. This reduces the risk of funds being misused or misappropriated, adding a level of transparency and security when addressing traders’ funds.

Compliance with KYC requirements

To verify the identity of its traders, Exness follows strict compliance with KYC requirements. When opening an account, you need to provide certain documents that verify your location and identity. This helps prevent money laundering, confidentiality of funds, and other illegal activities, maintain the integrity of the platform, and protect the interests of traders.

Tips for a Simple Transaction Process

To ensure a simple and user-friendly experience when depositing and withdrawing your funds on Exness, here are some practical tips to remember:

- Quickly verify your account by providing supporting documents so there are no deposit or withdrawal restrictions.

- Find out your account balance so that you have enough funds in your account before you submit a withdrawal request.

- If you encounter any technical issues with your deposits or withdrawals, contact the customer support team for assistance.

- Use the same payment method for all your deposits and withdrawals so you won’t have any potential problems receiving your funds.

- Double check banking details when making deposits and withdrawals so that there are no delays or processing errors.

Customer Support and Assistance

To get detailed information or assistance regarding Exness deposits and withdrawals, contact their professional support team and get answers to your questions. The customer support team is available 24/7 and you can communicate with them via live chat, email, or phone. However, the support team will require you to provide your support PIN and account number if you already have an account.

Conclusion

Exness strives to provide you with a seamless deposit and withdrawal experience, making it a leading platform for online financial traders globally. By following the steps and tips we have provided in this guide you can successfully use your Exness account. Remember to research the different payment methods available and if you have any questions, do not hesitate to contact the Exness support team.

FAQs about Exness Payments

What deposit and withdrawal methods are available at Exness?

Exness offers a variety of deposit and withdrawal methods, which typically include bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. The availability of these methods may vary depending on your region.